Ever wondered how your healthcare organization can optimize its financial processes while improving patient care?

Revenue Cycle Management (RCM) is essential for hospitals, clinics, and healthcare systems aiming to streamline billing, improve cash flow, and enhance patient satisfaction.

At Cadence Collaborative, we are committed to helping healthcare providers succeed in every aspect of RCM, from improving operational efficiency to enhancing financial health.

Stay with us, and discover how a strong RCM foundation can transform patient experiences and organizational success.

What Is the Primary Goal of RCM?

The primary goal of revenue cycle management (RCM) goes beyond simply ensuring payments are collected. In fact, it’s a strategic process that integrates financial health with operational efficiency.

At its core, RCM aims to optimize every interaction related to revenue generation, starting from patient registration to the final payment reconciliation.

But here’s something most people might not realize: small inefficiencies at any stage can lead to significant revenue losses, often in ways that aren’t immediately obvious.

For example, did you know that a mere 1% increase in denial rates can translate into tens of thousands of dollars in lost revenue for a mid-sized practice?

Many organizations overlook the impact of denial management, assuming denials are inevitable.

But the truth is, up to 90% of denied claims are preventable with the right processes in place, as shown by data from the HFMA.

RCM’s primary function is not just reactive (fixing problems like denied claims), but also proactive. This means reducing delays and errors before they happen.

How to Evaluate the Performance of Your RCM?

To evaluate your Revenue Cycle Management (RCM) performance, start by examining key areas like collection rate, average days to payment, and claim denial rates.

Ask yourself: are payments being received on time? Are there processes that could be streamlined?

This approach helps you spot bottlenecks and adjust strategies to maximize returns, ensuring the financial health of your organization.

Mastering the core steps of Revenue Cycle Management (RCM) can be a game-changer, turning complex billing and reimbursement processes into a seamless flow.

By fine-tuning each stage, you gain control over payment timelines, reduce setbacks, and ultimately enhance financial stability.

The Key Steps in Revenue Cycle Management

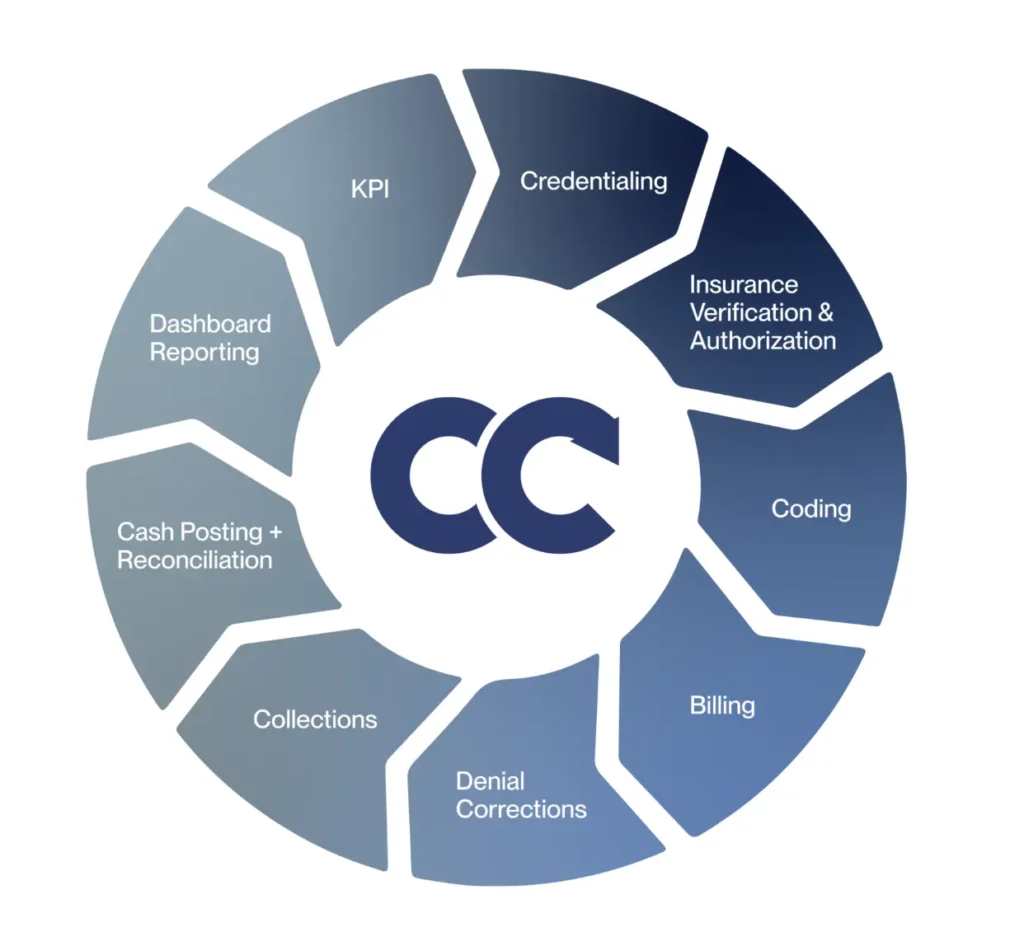

Revenue Cycle Management (RCM) is the process that moves a healthcare organization from patient registration to payment.

Each step in RCM works together to make sure payments are accurate and timely, minimizing delays and errors that can impact cash flow.

1. Credentialing

Credentialing is the essential process of verifying healthcare providers’ qualifications to participate in insurance networks and bill for their services.

Beyond confirming degrees or licenses, it involves a thorough review of providers’ history, specialties, and malpractice claims, ensuring they meet the standards set by insurance companies.

How Credentialing Prevents Reimbursement Delays?

Credentialing acts as a safeguard against reimbursement delays by confirming that healthcare providers meet the necessary qualifications and are approved by insurance networks.

This process helps prevent delays by ensuring providers meet insurance requirements, minimizing the risk of claims being flagged or denied due to credentialing issues.

Verified credentials allow claims to move smoothly through the system, reducing the chance of bottlenecks and enabling a consistent flow of reimbursements.

This focus on streamlined credentialing keeps billing efficient and supports a reliable revenue cycle.

2. Insurance Verification & Authorization

Insurance verification and authorization are essential steps in ensuring that a patient’s healthcare costs are covered by their insurance.

Verification involves checking a patient’s insurance details—such as coverage limits, copays, and deductibles—to confirm that they are eligible for the services they’re receiving.

This helps clarify any financial responsibility the patient might have upfront, avoiding unexpected costs.

Authorization, on the other hand, is the process of obtaining approval from the insurer for specific treatments or procedures before they’re provided.

This is especially important for costly or specialized services that often require prior approval to guarantee coverage.

By completing both verification and authorization early, healthcare providers minimize the risk of claim denials and make the billing process smoother for both the practice and the patient.

How to Prevent Claim Denials from the Start

Preventing claim denials begins with thorough insurance verification to confirm patient eligibility and coverage before services are provided.

Start by verifying insurance details as soon as an appointment is scheduled, confirming plan specifics like coverage limits, copayments, and deductibles.

For services requiring pre-authorization, secure it in advance to avoid denials later. Double-check patient information for accuracy—small errors in demographics or policy numbers can lead to rejections.

A proactive approach to these details reduces claim denials and creates an efficient billing process.

3. Medical Coding

Medical coding is like creating a bridge between the care a patient receives and the insurance payments that keep a healthcare practice running.

Each treatment, test, or procedure is converted into a code that insurers recognize and process. But it’s not just about typing numbers—it’s about getting every detail right.

When coding is accurate, claims are approved quickly, ensuring payments flow as they should.

Missteps, though, can lead to rejected claims or lost revenue, which is why accurate coding is such a big deal in healthcare.

How to Minimize Coding Errors to Maximize Revenue

Cutting down on coding errors doesn’t just protect revenue—it keeps the whole billing process running smoothly.

One way to do this is by offering your team regular training, so they’re always up-to-speed with any new or updated codes.

Periodic audits are also useful for catching small mistakes before they grow into bigger issues that slow down payments.

Plus, using reliable coding software can be a game-changer; it flags potential errors, making sure each claim is as accurate as possible before it’s submitted.

4. Medical Billing

Medical billing is all about making sure that payments for healthcare services come in on time and without a hitch.

This process is more than just sending an invoice—it’s about having a system that’s both quick and reliable.

When billing is done right, healthcare providers get paid faster, which means less financial stress and a smoother experience for patients too.

How to Ensure Timely and Accurate Billing

To keep billing efficient, using tools like automation and electronic submissions can make a huge difference.

Automation takes care of repetitive tasks that might otherwise take up time, and electronic submissions send claims to insurers directly, cutting out delays.

Together, they help avoid manual mistakes and speed things up so payments arrive sooner.

Regularly checking for any billing errors and staying on top of claim updates also helps keep the revenue flowing smoothly—because a small tweak here and there can often save time and reduce stress across the board.

5. Denial Management

Denial management focuses on reducing the number of rejected claims and quickly addressing them when they do happen.

Each denied claim represents a delay in payment and potential revenue loss, so having a solid approach to handling denials is essential.

Effective denial management not only keeps cash flow steady but also strengthens the overall revenue cycle by making sure claims go through with fewer issues over time.

How to Minimize Claim Denials Through Proactive Management

Start by identifying the most frequent reasons for denials, whether it’s missing documentation, coding errors, or authorization issues.

Once these patterns are clear, focus on adjusting workflows to catch these errors early.

Using automated checks and pre-submission reviews can also prevent common mistakes from slipping through.

6. Collections

In healthcare, collections mean securing payments from both patients and insurers to keep cash flow steady.

A solid collection process helps reduce outstanding balances and makes sure the organization gets the funds it’s earned.

How to Improve Collection Rates from Insurers

Improving collections from insurers starts with a system for tracking unpaid claims.

Staying organized with a list of claims due helps keep the process on track, making it easy to spot and follow up on delayed payments.

Regular, persistent follow-ups with insurers are key—consistent check-ins on unpaid claims show insurers that your organization stays on top of its receivables.

Plus, using claims management tools can simplify the tracking process, giving you quick insights into the status of each claim, reducing delays, and boosting the reliability of cash flow.

7. Cash Posting & Reconciliation

Cash posting and reconciliation ensure that every payment received aligns precisely with what was billed.

Accurate tracking of each dollar received keeps financial records clear, reducing the chance of mismatches or missed payments.

This attention to detail is essential for maintaining trustworthy financial reporting and a stable revenue cycle.

How to Ensure Accurate Cash Posting

To keep cash postings accurate, start by setting up a system to double-check each payment against the original billed amount.

Cross-referencing payments with claims helps catch discrepancies early, so they don’t throw off financial reports.

Automating parts of the cash posting process can also minimize errors, ensuring entries are consistent and easy to track.

Additionally, regular reconciliation reviews help spot any irregularities, keeping financial records clean and up-to-date.

8. Dashboard Reporting

Dashboard reporting uses data visualization tools to give a clear, real-time view of how the revenue cycle is performing.

By tracking key metrics—like claim approval rates, denial trends, and payment timelines—teams can quickly spot patterns and see where improvements are needed.

Dashboards turn complex data into actionable insights, helping healthcare providers make informed decisions that keep cash flow steady and operations efficient.

9. KPI Tracking

Regularly tracking KPIs allows healthcare organizations to gauge the health of their RCM efforts.

By keeping an eye on these metrics, teams can measure success, identify weak spots, and ensure that adjustments are made where needed to prevent revenue loss.

How to Use KPIs to Optimize Your Revenue Cycle

Looking at KPI data isn’t just about tracking numbers—it’s about spotting patterns that show where things could work better.

By using these insights to set realistic goals, healthcare teams can make focused adjustments that actually improve their processes.

Small changes based on these trends add up, making the revenue cycle smoother, faster, and more reliable over time.

Why You Need an RCM Partner

An RCM partner can be the missing link between your organization and a truly optimized revenue flow.

Beyond just managing billing and claims, the right partner empowers you with tools and insights to tackle denials, speed up payments, and free your team from endless administrative tasks.

With the right RCM partner, you’re not just getting support, you’re gaining a strategic advantage that elevates your entire operation.

Optimize Your Revenue Cycle with Cadence Collaborative

Seeing all the steps and details involved in Revenue Cycle Management (RCM) can feel overwhelming—but there’s no need to worry.

At Cadence Collaborative, we handle every part of the process for you. From reducing claim denials to streamlining billing, we make sure your revenue cycle runs smoothly, so you can focus on what matters most: providing great patient care.

Ready to simplify your RCM? Partner with Cadence Collaborative for expert support and a hassle-free experience. Contact us today!