Just when you think you’ve figured out the right codes, a small detail like Modifier SA shows up and throws everything into question.

Maybe you’ve seen it on a claim. Maybe someone on your team brought it up during an audit. Or maybe you’ve avoided it completely, hoping it doesn’t apply to your practice. But here’s the thing.

If you’re working with nurse practitioners or physician assistants, Modifier SA is probably more relevant than you think.

At Cadence Collaborative, we’ve helped healthcare teams across the country clean up their billing processes and increase reimbursement accuracy. And Modifier SA? It’s one of the most common sources of confusion we see.

The good news is that it doesn’t have to stay confusing. In this guide, we’re breaking everything down in plain language.

Let’s start with what Modifier SA actually means and how it fits into the broader world of collaborative care billing.

What Modifier SA Actually Means in a Billing Context

Modifier SA is more than just two letters on a claim. It tells the story of how a service was delivered and who provided it.

When used correctly, it creates transparency between the billing team and the payer. When used incorrectly, it can trigger denials or audits.

This modifier is especially important in settings where nurse practitioners or physician assistants are involved in patient care. It helps clarify that while a physician may be the billing provider, someone else delivered the service under proper supervision.

Understanding how Modifier SA works is the first step to using it with confidence.

The Technical Definition of Modifier SA

Modifier SA is a HCPCS Level II billing modifier. It’s used to indicate that a nurse practitioner or physician assistant performed the service in collaboration with a physician.

In many cases, this means the service was provided incident to the physician’s care and is being billed under the physician’s national provider identifier.

But here’s what makes it tricky. Not every payer looks at it the same way. Some require it. Others don’t recognize it at all. And Medicare? Medicare has its own rules entirely, which we’ll get into soon.

Who Modifier SA Applies To

Modifier SA only applies in very specific cases. If you’re billing services under the supervising physician’s NPI but the work was done by a nurse practitioner or physician assistant, that’s when SA comes into play.

If the NP or PA is billing under their own name and NPI, Modifier SA is not used. It’s meant to reflect collaborative billing relationships, not solo practice.

In most states, this modifier shows up when there’s a formal supervisory agreement in place. In others, especially those that grant full practice authority to NPs, the use of SA might not be required at all.

Knowing your state’s laws and the policies of your payers is key.

When You Should Use Modifier SA and What Must Be in Place

Knowing what Modifier SA means is only the beginning. The real challenge is figuring out when you’re actually supposed to use it. And that’s where a lot of confusion starts.

This modifier isn’t for every service or every provider. It only comes into play when a specific billing structure is being used.

And it depends heavily on how your practice operates and how your payers define supervision and collaboration.

Modifier SA Is Tied to Incident To Billing

Most of the time, Modifier SA is used in connection with something called incident to billing. This is a billing arrangement where services provided by non-physician practitioners, like nurse practitioners or physician assistants, are billed under the physician’s NPI.

Why would you do this? Because billing under the physician can often lead to higher reimbursement rates, especially when compared to billing under the NP or PA directly.

But here’s the catch. You can’t just bill this way whenever you want. There are specific conditions that must be met.

Key Conditions for Incident To Billing with Modifier SA

To use Modifier SA correctly, the following must be true:

- The service is part of the physician’s established treatment plan.

- The physician is physically present in the office suite during the service.

- The NP or PA is working within their scope of practice, as defined by state law.

- The payer accepts and requires Modifier SA as part of its claim review process.

If any of these pieces are missing, Modifier SA doesn’t apply.

This is why documentation matters so much. It’s not just about the service provided, but about proving that all the conditions around it were met too.

How Modifier SA Rules Differ Between Medicare, Medicaid, and Private Payers

One of the biggest mistakes billing teams make with Modifier SA is assuming all payers treat it the same way. They don’t.

In fact, the rules can vary significantly depending on whether you’re billing Medicare, Medicaid, or a commercial insurance plan.

This inconsistency is one of the main reasons Modifier SA causes so much confusion. To avoid denials and compliance issues, it’s essential to understand how each payer approaches it.

Why Medicare Doesn’t Recognize Modifier SA

Let’s start with Medicare. Despite how common Modifier SA is in other programs, Medicare does not use or require this modifier at all.

Medicare has its own set of rules when it comes to services provided by non-physician practitioners. It allows incident to billing under specific conditions, but it does not expect to see Modifier SA on the claim.

If you include it anyway, Medicare won’t necessarily deny the claim, but it may ignore the modifier altogether. Worse, including unnecessary modifiers can flag a claim for further review.

So if you’re billing Medicare, double-check whether you’re using Modifier SA out of habit or necessity. In this case, less might actually be more.

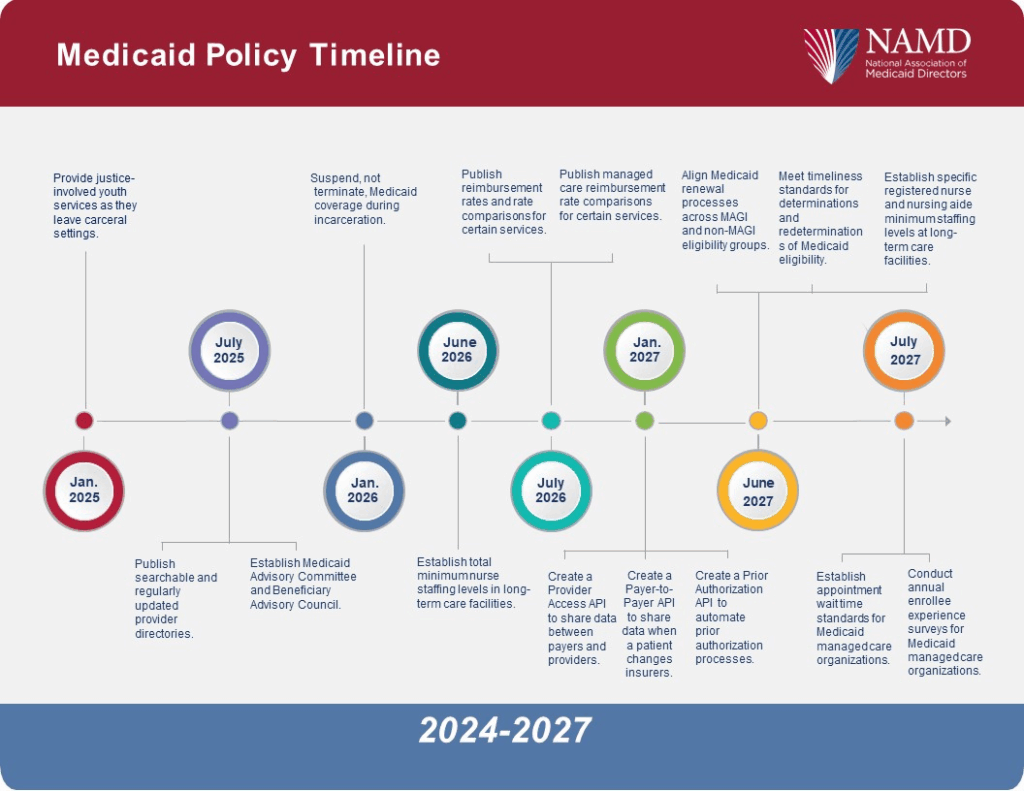

Modifier SA Is Often Required by Medicaid Programs

Unlike Medicare, many Medicaid programs do require Modifier SA when billing incident to services. This is especially true in states where Medicaid has adopted policies to track and report services performed by NPs and PAs, even when the physician’s NPI is used on the claim.

That means if you’re working with Medicaid patients, your billing team should be very familiar with your state’s requirements.

The tricky part is that these rules vary from state to state. Some Medicaid plans require Modifier SA on every claim involving a midlevel provider. Others only require it in certain types of visits, like behavioral health or primary care.

The best way to stay compliant is to keep a payer-specific modifier policy list on hand and update it regularly. And when in doubt, call the plan directly or check their most recent provider manual.

Commercial Payers Have Their Own Modifier SA Rules

Private insurance plans also make their own rules. Some commercial payers follow Medicare’s lead and don’t use Modifier SA. Others mirror Medicaid and require it for collaborative billing scenarios.

For example, some national insurers require Modifier SA for services rendered by a nurse practitioner in a retail clinic, but not in a hospital outpatient setting. Others might request it for urgent care claims only.

That’s why understanding each payer’s preference is critical. If you submit a claim without Modifier SA when it’s required, or with it when it’s not, there’s a good chance it gets delayed or denied.

Why Modifier SA Requires More Than Just Knowing the Rules

Even with the clearest guidelines, using Modifier SA correctly isn’t something most practices should try to handle alone. That’s because applying this modifier touches multiple areas at once, from payer-specific rules to clinical supervision to how your documentation is structured.

At Cadence Collaborative, we’ve seen firsthand how Modifier SA is often misunderstood or misused, even by experienced teams. And that’s not because they don’t know what it means.

It’s because this modifier depends on real-time decisions, detailed documentation, and payer-by-payer nuance that’s constantly evolving.

That’s where expert support makes all the difference.

The Role of Documentation in Modifier SA Compliance

To justify Modifier SA on any claim, your documentation needs to do more than describe the service. It needs to clearly show that all the conditions for incident to billing were met.

That includes:

- The supervising physician’s involvement in the care plan

- Confirmation that the physician was on-site during the visit

- Evidence that the service was delivered within the NP or PA’s scope of practice

- Proper credentialing and delegation under state law

- Payer-specific guidance that supports the use of SA

But here’s the reality. Most clinical teams don’t have the time or bandwidth to align all of that perfectly, especially when payer rules are inconsistent. And when there’s a mistake, it’s not always caught right away. Instead, it shows up months later as a denial, repayment demand, or even an audit.

Why Partnering With a Billing Team Like Cadence Collaborative Is Essential

Getting Modifier SA right isn’t about memorizing rules. It’s about having the right systems in place to make sure those rules are applied consistently and defensibly.

We specialize in helping healthcare practices navigate complex billing modifiers like SA.

We track payer policies, review documentation for compliance, and make sure claims are submitted correctly the first time.

That level of support protects your revenue, your team, and your reputation. And it gives you the peace of mind to focus on patients, not paperwork.

If you’re not sure whether you’re using Modifier SA properly, or if you’re not using it at all and should be, this is the moment to bring in backup. We’re here to help.

Common Modifier SA Mistakes That Cost Practices Time and Money

Modifier SA might look simple on paper, but in the real world, it’s one of the most misapplied billing tools out there. And when it’s used incorrectly, the impact goes beyond a single claim.

We’ve worked with practices that didn’t even realize they were billing Modifier SA wrong until a denial backlog or audit forced them to investigate.

These kinds of mistakes don’t just slow things down. They put your revenue and compliance at risk.

Here are the most common ways Modifier SA goes off track.

Mistake 1: Applying Modifier SA to Services That Don’t Qualify as Incident To

Just because a nurse practitioner or physician assistant provided a service doesn’t mean Modifier SA applies. If there’s no active physician supervision or no established care plan from the physician, then incident-to billing isn’t an option.

This is a critical detail that many teams miss, especially in clinics with rotating schedules or part-time supervising providers. And once the claim is flagged, documentation alone might not be enough to justify the billing.

Mistake 2: Assuming All Payers Require Modifier SA

Each payer has its own approach to Modifier SA. Some require it for incident to billing. Others don’t recognize it at all. Submitting Modifier SA on a claim to the wrong payer can cause confusion, lead to denials, or delay payment.

Without a payer-specific billing strategy in place, teams end up guessing. And guessing is expensive.

Mistake 3: Billing With Modifier SA but Lacking Supporting Documentation

This is one of the fastest ways to trigger an audit. Modifier SA needs to be backed by solid, consistent documentation. That includes progress notes, proof of physician presence, credentialing files, and scope of practice records that match state law.

When documentation is rushed, incomplete, or inconsistent, even a clean-looking claim can unravel under review.

Mistake 4: Treating Modifier SA Like a Standard Code Instead of a Strategic Tool

Some teams add Modifier SA automatically to any claim involving a midlevel provider. But this modifier isn’t a default. It’s a strategic billing tool that only works under specific conditions.

When it’s misused, it signals to payers that there may be broader issues in how the practice handles supervision, coding accuracy, or billing policy compliance.

Final Thoughts

Modifier SA looks simple, but using it the wrong way can cost your practice more than you think. Denials, audits, and underpayments usually come down to one thing: guesswork.

That’s why Cadence Collaborative doesn’t leave billing to chance. We bring strategy, clarity, and expert support to every claim. From Modifier SA to payer-specific rules, we help you stay compliant and get paid what you’ve earned.

If your practice relies on midlevel providers, accurate billing matters more than ever. Don’t let small details block full reimbursement.

Need help with Modifier SA or full-service medical billing support? Contact us today and let’s make your claims stronger, together.