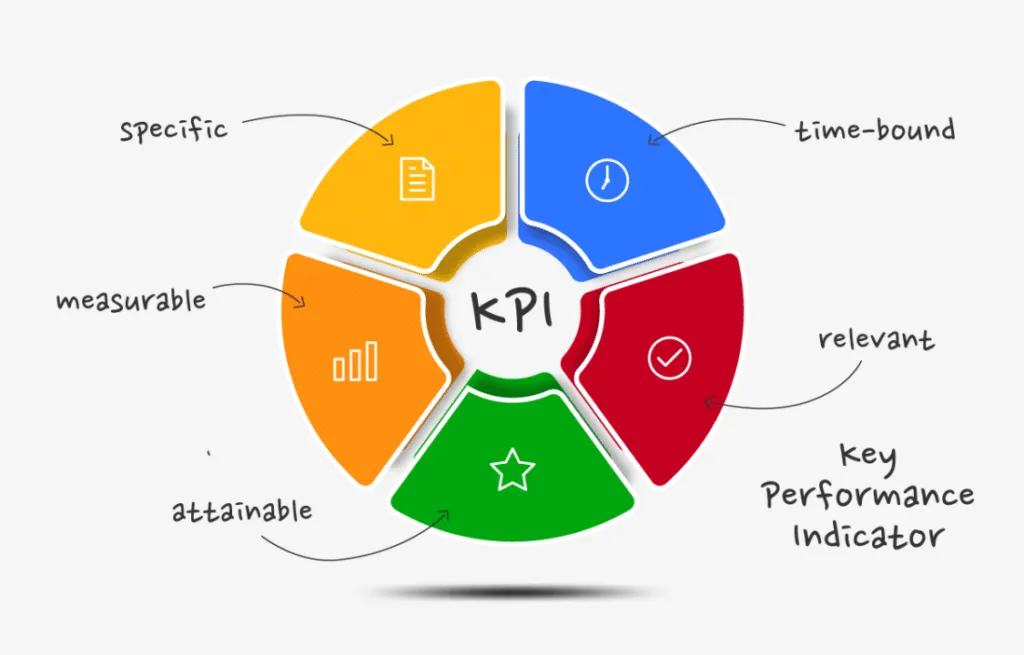

Running a healthcare practice isn’t just about patient care—it’s also about getting paid (accurately and on time). That’s where KPIs (Key Performance Indicators) and analytics come in. They turn messy billing data into clear, actionable insights that help you boost revenue, cut costs, and speed up payments.

But let’s be real—many healthcare organizations don’t track the right KPIs or don’t use analytics to their full potential. That means money gets stuck in claims denials, billing errors go unnoticed, and revenue leaks keep happening.

Want to stop losing money and optimize your revenue cycle? It starts with knowing what to track, how to analyze it, and what actions to take. Let’s break it down.

How KPIs Keep Your RCM on Track

Think of KPIs as the vital signs of your revenue cycle—just like doctors monitor heart rate and blood pressure to check a patient’s health, KPIs tell you if your billing, collections, and reimbursements are working as they should.

But not all KPIs are created equal. Tracking too many metrics (or the wrong ones) can lead to information overload. The key is focusing on the numbers that actually move the needle for your revenue.

Here are a few must-track KPIs that separate a smooth RCM from a financial headache:

- Days in Accounts Receivable (A/R): How long it takes to get paid. If this number is high, you’ve got cash flow issues.

- Clean Claim Rate (CCR): The percentage of claims that go through without rejections or errors. A low CCR means you’re spending too much time fixing mistakes.

- Denial Rate: The percentage of claims insurers reject. Keeping this low is mission-critical for steady revenue.

- Net Collection Rate: The actual revenue collected versus what you’re owed. If this number isn’t close to 100%, money is slipping through the cracks.

Why It Matters:

KPIs don’t just give you numbers, they tell a story about where money is getting stuck and what needs to change. Without them, you’re flying blind.

How Analytics Turn KPIs Into Action

KPIs are great, but raw numbers don’t fix problems—smart decisions do. That’s where analytics come in.

Instead of just looking at data, analytics dig deeper to find patterns, trends, and hidden issues in your revenue cycle.

For example:

Your denial rate is high? Analytics can show if it’s a coding issue, a payer problem, or a specific procedure that keeps getting denied.

A/R days creeping up? Data might reveal that one payer is consistently slow, or that certain claims sit in limbo too long before being followed up on.

Revenue isn’t where it should be? Maybe you’re underbilling for certain services, or missing opportunities to appeal denied claims.

What Analytics Reveal That KPIs Alone Can’t

KPIs are like warning lights on a dashboard—they tell you something is off. But analytics? They pop the hood and show you exactly what’s broken.

Let’s say your claim denial rate is creeping up. You know it’s bad, but without analytics, you’re just guessing at the cause. Is it coding errors? Payer policy changes? Missing documentation?

With RCM analytics, you can:

- Pinpoint patterns—maybe 70% of denials are coming from just one payer.

- Spot trends over time—are denials getting worse for certain procedures?

- See bottlenecks—maybe claims are getting stuck in manual review longer than they should.

Example: A practice was struggling with low net collection rates. KPIs showed the issue, but analytics revealed the root cause—their self-pay patients weren’t following through on payments after insurance adjustments.

The fix? A new automated follow-up system that reminded patients before balances were overdue.

Without analytics, you’re reacting. With analytics, you’re preventing problems before they cost you.

How to Actually Use RCM Analytics (Beyond Reports)

Data is only useful if you act on it. Too many organizations collect reports but never turn them into real changes.

Here’s how to make analytics work for you:

- Automate Insights: Don’t waste time manually tracking KPIs—use RCM software to flag trends and risks in real-time.

- Benchmark Performance: Compare your numbers to industry standards and similar organizations. Are you above or below average?

- Set Alerts for Red Flags: Get notified if denials spike, A/R days jump, or collection rates drop. Don’t wait for end-of-month reports to catch revenue leaks.

- Optimize Staff Workflows: Use data to reassign workloads—if one team member handles claims faster and more accurately, why not train others with their best practices?

- Adjust Payer Strategy: If one payer consistently delays payments, renegotiate contracts or prioritize follow-ups with that insurer.

Turning Data Into Real RCM Improvements

Knowing your KPIs and digging into analytics is only half the battle. The real impact happens when you use that data to make smarter decisions, fix bottlenecks, and improve cash flow.

Here’s how to put everything into action:

1. Focus on Quick Wins First

Not all problems require a massive overhaul. Some small tweaks can have an instant impact:

- Fix common coding errors that lead to claim denials.

- Automate follow-ups for outstanding patient balances.

- Streamline prior authorization processes to prevent delays.

2. Build a Continuous Improvement Loop

RCM isn’t “set it and forget it.” The best-performing organizations constantly refine their processes by:

- Reviewing KPI trends weekly, not just monthly.

- Testing small process changes and measuring the impact.

- Holding RCM review meetings with finance & billing teams to catch new issues before they snowball.

3. Train Your Team to Use Data

Even the best analytics won’t help if your billing and revenue teams aren’t using them.

- Train staff to spot red flags early instead of waiting for reports.

- Give coders and billers up-to-date training to prevent errors before claims go out.

- Encourage collaboration between finance, billing, and clinical staff—everyone plays a role in keeping revenue healthy.

With Cadence Collaborative, you don’t need to worry about training your team to catch billing errors or track KPIs manually. We handle everything: billing, financial reporting, revenue cycle analysis, medical coding, and more.

Our experts ensure that claims are coded correctly the first time, denials are minimized, and revenue flows smoothly. No more guessing, no more training sessions—just seamless, optimized revenue cycle management.

How to Future-Proof Your Revenue Cycle

Healthcare revenue cycle management isn’t just about keeping up—it’s about staying ahead. Payer policies are always shifting, regulations are tightening, and reimbursement models are evolving. If your RCM strategy is reactive, you’re constantly putting out fires. But if you take a proactive, data-driven approach, you don’t just manage revenue—you maximize it.

Future-proofing your revenue cycle starts with predictive analytics. Instead of waiting for denials to pile up, smart analytics can flag potential issues before claims even go out.

Identifying payer trends, spotting coding discrepancies, and analyzing underpayments in real-time means less revenue loss and faster reimbursements. When you know where money is getting stuck, you can prevent delays instead of fixing them after the fact.

The future of RCM isn’t about working harder, it’s about working smarter. Organizations that invest in advanced analytics, automation, and expert management will not only avoid revenue setbacks but also create a financially resilient practice that thrives in an unpredictable healthcare landscape.

Start Optimizing Your Revenue Cycle

Managing revenue shouldn’t feel like an uphill battle. Yet, too many healthcare organizations find themselves stuck in a cycle of denied claims, delayed reimbursements, and endless administrative work. The real issue? An outdated approach to RCM that’s reactive instead of proactive.

That’s where Cadence Collaborative changes the game. We don’t just process claims—we refine your entire revenue strategy. With end-to-end billing, coding, financial reporting, and real-time analytics, we identify revenue leaks before they happen and optimize every step of the process.

No more chasing payments. No more manual guesswork. Just faster reimbursements, fewer denials, and a financial system that actually works for you.

Let’s talk about how we can streamline your revenue cycle and maximize your collections. Contact us and schedule a free consultation today.