Have you noticed that despite your efforts to streamline operations, your practice’s revenue cycle management (RCM) still seems to be draining more resources than it should?

Many practices unknowingly overlook the inefficiencies in their RCM, which can lead to significant financial losses.

In this article, we’ll highlight five signs that your RCM is costing you more than you think, from billing errors to slow collections.

At Cadence Collaborative, we specialize in helping practices optimize their revenue cycle to improve profitability.

Keep reading to discover how to identify and address these costly issues before they take a bigger toll on your bottom line.

1. High Claim Denial Rates

If claim denials are stacking up, it’s time to pay attention.

A high denial rate isn’t just annoying; it’s a neon sign that something in your process isn’t working.

Whether it’s incorrect coding, missing documents, or outdated patient info, every denial is money left on the table.

Why Are High Denial Rates a Big Deal?

Every claim denial is more than just a delay—it’s a direct hit to your revenue stream. That’s money you rely on to pay for essential operations, support your team, and continue delivering exceptional care.

When denials start to pile up, the impact extends beyond cash flow; it creates a ripple effect that can destabilize the efficiency of your entire practice.

It’s not just about the revenue lost. Denials demand extra resources to track down errors, correct them, and resubmit claims. This extra effort can divert focus from improving processes and meeting patient needs.

The real question is, what’s causing the leaks in the first place? High denial rates often point to systemic problems, such as:

- Outdated or Incorrect Coding: Even a small mistake, like using an old code or missing a modifier, can lead to outright rejections.

- Missing Documentation: Incomplete patient records or lack of supporting documents can derail claims before they even get started.

- Insurance Verification Errors: If eligibility isn’t verified upfront, claims might be denied for something as basic as an inactive policy.

Each denial isn’t just a missed opportunity—it’s also a signal that something in your RCM process needs attention.

Tackling these root causes not only reduces denial rates but also strengthens your revenue cycle and sets your practice up for long-term success.

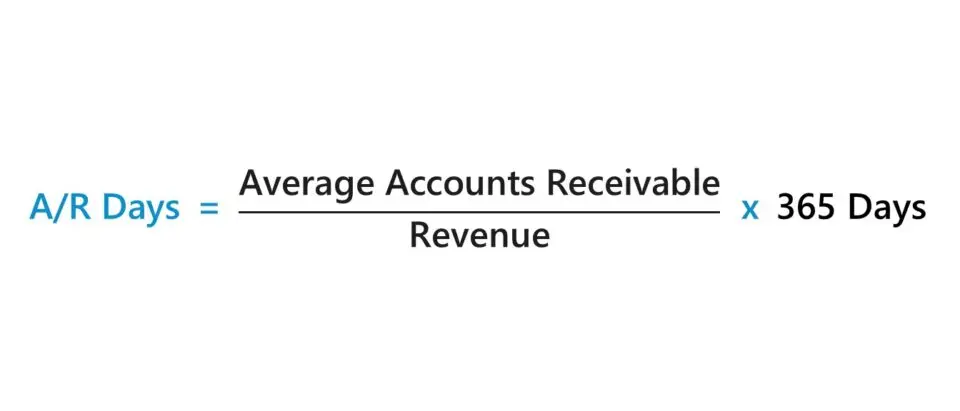

2. Increased Days in Accounts Receivable (A/R)

Do you ever feel like you’re waiting forever to get paid? When the days in accounts receivable (A/R) start creeping up, it’s not just frustrating—it’s a cash flow killer.

Longer A/R cycles mean delayed revenue, which can make it harder to cover operating costs, invest in growth, or even just maintain peace of mind.

What Does an Increase in A/R Days Mean for Your Cash Flow?

Think of it like this: every extra day a payment sits in A/R is a day you’re essentially giving your patients or payers an interest-free loan.

Meanwhile, your expenses—staff salaries, rent, supplies—keep piling up. It’s a vicious cycle that can strain your financial flexibility and leave you scrambling to make ends meet.

More importantly, a rise in A/R days often points to underlying inefficiencies in your billing process.

Whether it’s a lag in claim submissions, follow-ups, or patient billing errors, these delays can snowball into significant financial headaches.

How Can You Reduce A/R Days?

The good news? There’s plenty you can do to speed things up:

- Streamline Your Billing Processes

Submitting claims quickly and accurately is half the battle. Make sure your team is working with the right tools and training to get it right the first time. - Follow Up (Religiously!)

Denied or delayed claims won’t resolve themselves. Have a dedicated team or system in place to follow up on unpaid claims before they go stale. - Get Patients on Board

Clear communication with patients about their financial responsibility can go a long way. Offering online payment options or setting up payment plans can help ensure you get paid faster. - Use Data to Your Advantage

Regularly review your A/R metrics. What’s holding payments up? Identifying trends can help you pinpoint and address bottlenecks before they spiral.

Reducing A/R days isn’t just about chasing payments—it’s about creating a smoother, more predictable revenue cycle.

3. Low Clean Claim Rate

Clean claims are the gold standard in revenue cycle management—those flawless submissions that get approved and paid on the first attempt.

If your clean claim rate is lagging, it’s a clear indicator that something in your processes needs attention. And trust us, this is one metric that directly impacts both efficiency and profitability.

What Is a Clean Claim Rate?

Your clean claim rate measures the percentage of claims submitted correctly the first time, without needing edits or rejections.

A high clean claim rate means fewer delays, faster payments, and less back-and-forth with insurance companies.

It’s like hitting a bullseye on the first throw. A low rate, on the other hand, means wasted time, frustrated staff, and money stuck in limbo.

Think of it this way: every claim that isn’t clean has to be corrected and resubmitted, which eats up staff hours and slows down your cash flow. And the longer a claim takes to get resolved, the less likely it is to ever be paid.

How Can You Improve Your Clean Claim Rate?

Getting your clean claim rate up isn’t rocket science, but it does take focus and consistency. Here are a few strategies that can make a big difference:

- Invest in Staff Training

Your team is on the front lines of claim submissions, so it’s critical they know the latest coding standards, insurance rules, and best practices. Regular training keeps everyone sharp and reduces errors.

- Leverage Technology

Use billing software that flags potential issues before a claim is submitted. Automation tools can catch common mistakes, like missing codes or mismatched patient information, so your claims are clean from the start.

- Audit Before Submission

Make pre-submission audits a regular part of your process. A quick double-check can catch small errors before they become big headaches.

- Communicate with Payers

Every insurance company has its quirks. Build strong relationships with your top payers to better understand their specific requirements and preferences.

- Streamline Front-End Processes

Many claim errors start at the point of patient intake. Ensure your team is collecting accurate and complete information upfront, including insurance details and eligibility verification.

4. High Operational Costs Due to Reworking Claims

When claims aren’t submitted correctly the first time, it sets off a costly domino effect.

Every reworked claim represents lost efficiency. Instead of focusing on submitting new claims or resolving higher-value tasks, your billing team has to go back, dissect what went wrong, and make corrections.

It’s a labor-intensive process that demands detailed attention, follow-ups with payers, and, often, resubmission. All of this pulls your team away from more productive tasks, driving up payroll costs without any added benefit.

More than that, reworked claims often lead to delayed payments. This disrupts your cash flow and creates uncertainty, making it harder to manage day-to-day expenses. Worse, the longer a claim stays unresolved, the less likely it is to get paid at all.

How Can You Prevent Claim Rework?

The key to avoiding claim rework lies in building strong processes from the start.

Accurate patient data collection and consistent eligibility verification are the foundation of error-free claims. It’s also about creating a culture of accountability where everyone understands their role in getting claims right the first time.

Technology plays a critical role too. Tools that automatically validate claims before submission can catch small errors early, ensuring fewer come back rejected. Regular audits of your workflow can help identify recurring issues, allowing you to fine-tune your processes before they become costly problems.

5. Missed Revenue Opportunities Due to Underbilling

Think of it like this: every patient interaction is a story, and every detail of that story has value.

When parts of the story go untold—whether it’s a procedure, a consultation, or a follow-up—it’s not just a missed billing line; it’s a missed opportunity to reflect the true effort and care your team provides.

Over time, those small gaps can grow into major revenue leaks, holding back your practice’s potential.

How Does Underbilling Affect Your Bottom Line?

Underbilling doesn’t just hurt your finances—it skews the entire picture of your practice’s performance.

When services go unbilled, it’s not only revenue lost today but also a distortion of how resources are allocated. You might find yourself questioning why cash flow is tight when, on paper, everything looks fine.

How Can You Ensure All Charges Are Captured?

Capturing every charge starts with clarity and precision. It’s about creating a system where no service—no matter how small—slips through the cracks.

This isn’t just about revenue; it’s about valuing the full scope of care your team provides.

The key lies in real-time documentation. Providers often overlook routine actions like quick evaluations or follow-ups, but these add up.

Embedding smart tools that simplify charge capture during the patient encounter ensures nothing is missed.

Equally important is fostering collaboration between care teams and billing staff, so that every step of the process is aligned and efficient.

With Cadence Collaborative, we go beyond basic fixes, offering tailored technology and expert guidance to integrate charge capture seamlessly into your workflows. Our goal? To ensure every charge reflects the care you deliver, fueling your financial health and operational excellence.

FAQ Section

What Is Considered a High Denial Rate?

A denial rate above 5% is generally considered high and could signal underlying issues in your RCM processes.

These issues might include errors in coding, incomplete documentation, or lapses in patient eligibility verification.

Keeping your denial rate below this threshold not only improves cash flow but also saves your team from spending excessive time on corrections and resubmissions.

How Do Long A/R Days Impact Cash Flow?

Long accounts receivable (A/R) days mean delayed payments, which can disrupt the steady flow of revenue your practice needs to operate smoothly.

Imagine waiting weeks or even months to collect payments while your expenses—like salaries, rent, and supplies—don’t wait.

The longer payments linger in A/R, the higher the chance they’ll remain unpaid, creating a strain on your financial health and limiting your ability to invest in growth.

How Can Underbilling Hurt My Practice?

Underbilling is more than just leaving money on the table—it’s undervaluing the care you provide. When services go unbilled or underbilled, your practice loses not only immediate revenue but also the ability to plan effectively for the future.

Over time, consistent underbilling can distort your financial picture, making it harder to budget, invest in new technology, or grow your team.

Even more, it can create a false sense of security, masking inefficiencies in your revenue cycle that could lead to bigger issues down the line.

Ready to Take Control of Your Revenue Cycle?

At Cadence Collaborative, we understand that managing your revenue cycle isn’t just about numbers—it’s about ensuring your practice thrives, your team is supported, and your patients receive the best care possible.

From reducing denial rates to capturing every charge with precision, we tailor our solutions to meet the unique needs of your practice.

Our team of RCM experts works side by side with you to eliminate inefficiencies, boost cash flow, and let you focus on what matters most: delivering exceptional healthcare.

Let’s transform your RCM together. Contact us today and start optimizing your revenue cycle for success!