Imagine running a complex machine. Each gear must work seamlessly, each component perfectly aligned.

That’s how the revenue cycle in healthcare functions—a delicate balance of billing, coding, claims, and reimbursements. But what happens when one cog in the machine falters? Errors creep in, denials spike, and revenue leaks.

Compliance audits are your diagnostic tool, the trusted mechanic uncovering inefficiencies, errors, and missed opportunities.

More than a regulatory necessity, these audits are a strategic powerhouse, helping healthcare providers tighten their revenue cycle processes while staying on the right side of regulations.

In this article, we’ll explore how compliance audits can identify inefficiencies, reduce denials, and strengthen your financial health. We’ll also show you how Cadence Collaborative’s expertise turns audits into a strategic advantage for your practice.

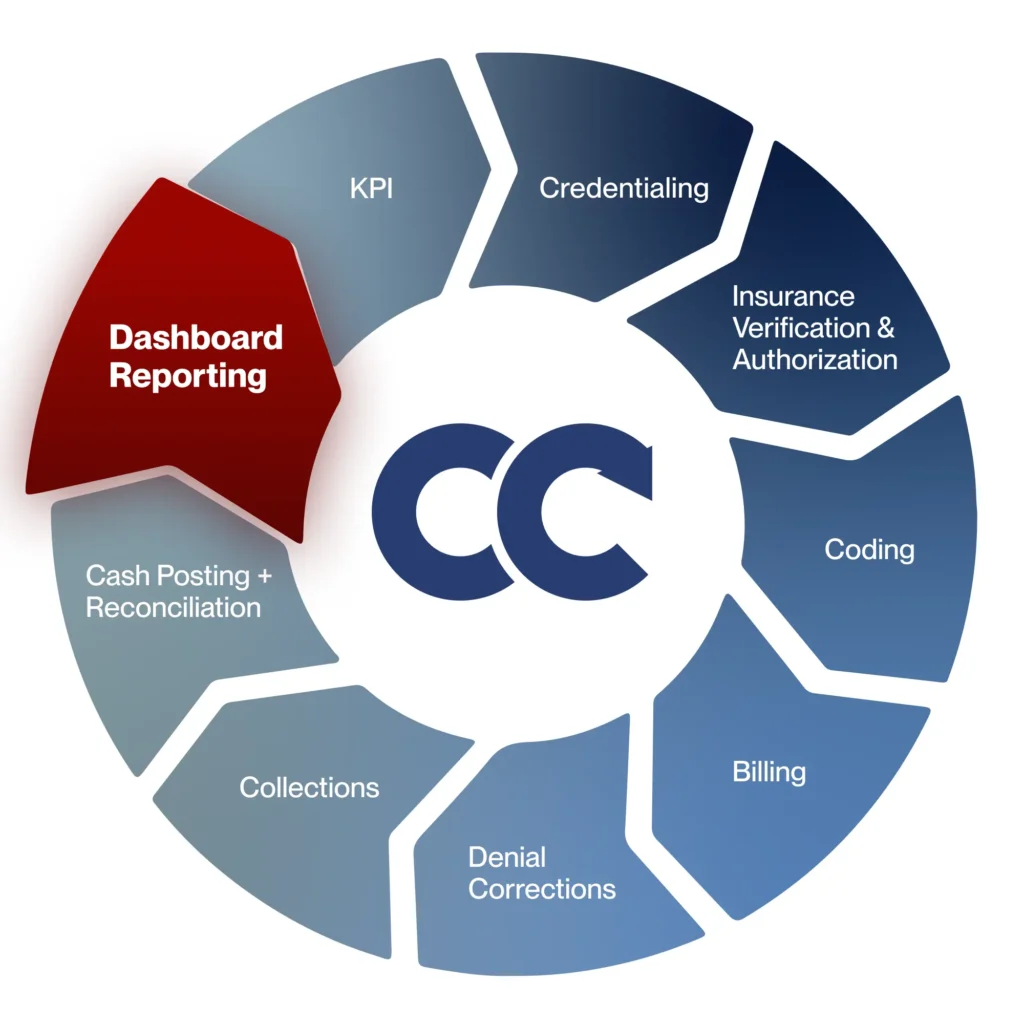

What Is Dashboard Reporting in Revenue Cycle Management?

Imagine having a single, easy-to-use screen that shows you everything you need to know about your practice’s financial health—claim statuses, cash flow, denial trends, and even patient payments. That’s dashboard reporting.

It’s like having a financial map that helps you navigate your revenue cycle with clarity and precision.

Dashboard reporting pulls data from every step of your RCM process and presents it in real time, so you don’t have to dig through endless spreadsheets or reports. Instead, you get clear, visual insights that show you exactly what’s working, what’s not, and where to focus your attention.

How Does Dashboard Reporting Work?

Dashboard reporting connects directly to your RCM systems, pulling data from key processes like billing, coding, collections, and cash posting. It organizes this data into visual charts, graphs, and summaries that are easy to understand. For example:

- If denial rates are rising, the dashboard shows which codes or claims are being rejected the most.

- If accounts receivable are aging, you can quickly see which accounts need immediate follow-up.

- If collections are slowing down, you’ll know where to direct your team’s efforts.

By delivering this data in real-time, dashboards give you the power to make quick, informed decisions that keep your revenue cycle running smoothly.

Struggling with Denials? Here’s How Dashboards Help

Denials are one of the most frustrating issues for healthcare providers. They slow down your cash flow, require time-consuming corrections, and often lead to lost revenue. Dashboard reporting helps you take control of denials by providing a clear, real-time view of where they’re happening and why.

Through dashboards, you can:

- Break down denial reasons: See if coding errors, late submissions, or incomplete patient information are causing the problem.

- Spot patterns over time: Identify recurring issues with specific insurers or services, so you can address them at the source.

- Track progress: Monitor how denial rates improve after implementing corrective actions.

With this level of insight, denials become manageable instead of overwhelming.

What Other Problems Can Dashboard Reporting Solve?

Dashboard reporting is more than just a tool for tracking metrics—it’s a solution to many of the challenges healthcare practices face in their revenue cycle. From improving transparency to addressing inefficiencies, it helps providers stay on top of their financial health.

1. Rising Denials

Claim denials can quickly spiral out of control if not addressed. The problem often lies in the lack of visibility into why denials are happening.

Dashboard reporting provides a clear, real-time view of denial trends, breaking down the root causes, such as coding errors, missing documentation, or eligibility issues. With this information, you can act quickly to correct errors and prevent future denials, keeping your claims moving smoothly.

2. Cash Flow Issues

When payments are delayed, your entire practice feels the strain. Dashboard reporting tracks payments across every step of your revenue cycle, highlighting bottlenecks and overdue accounts.

Whether the delay is on the insurer’s side or due to incomplete patient payments, dashboards allow you to pinpoint the problem and take action to improve your cash flow.

3. Compliance Gaps

Staying compliant with ever-changing healthcare regulations can be a daunting task. Dashboard reporting helps ensure your billing and coding processes align with current rules by tracking compliance-related metrics in real time.

This proactive approach reduces the risk of fines, audits, or other penalties, giving you peace of mind.

4. Lack of Real-Time Insights

Without real-time visibility into your revenue cycle, problems can go unnoticed until it’s too late. Traditional reporting methods often rely on outdated data, leaving practices reactive instead of proactive.

Dashboard reporting solves this by providing instant updates, ensuring you always have the latest information at your fingertips to make informed decisions.

5. Inefficient Workflow Management

When teams don’t know where to focus their efforts, productivity suffers.

Dashboard reporting prioritizes tasks by highlighting critical issues, such as pending claims, high-value accounts, or overdue collections. This helps your team work smarter, not harder and ensures that the most urgent tasks are addressed first.

6. Difficulty Tracking KPIs

Key performance indicators (KPIs) are essential for understanding how well your revenue cycle is performing, but manually tracking them can be time-consuming and error-prone.

Dashboards simplify KPI tracking by automatically compiling and displaying metrics like days in accounts receivable (A/R), clean claim rates, and collection efficiency in an easy-to-read format.

How Does Dashboard Reporting Help Your Team?

Dashboard reporting helps everyone in your practice stay on the same page.

Your billing team knows which claims to prioritize, your collections team sees overdue accounts at a glance, and your management team gets a clear picture of your practice’s financial health. No more guesswork, no more finger-pointing—just clarity and collaboration.

How to Get Started with Dashboard Reporting

If you’re ready to take control of your revenue cycle, implementing dashboard reporting is easier than you think. Start by identifying the metrics that matter most to your practice, like:

- Claim approval rates

- Days in accounts receivable (A/R)

- Denial rates

- Patient payment trends

Once you know what to track, choose a dashboard system that integrates seamlessly with your RCM tools. A good dashboard should be easy to customize, simple to navigate, and provide real-time updates. Don’t settle for outdated systems or clunky interfaces—this is about empowering your practice.

Why Every Healthcare Practice Needs Dashboard Reporting

It’s easy to think that dashboard reporting is only for large practices or hospitals, but that couldn’t be further from the truth. Every healthcare provider—no matter the size—can benefit from having real-time insights into their revenue cycle.

Here’s why:

- Small practices can use dashboards to streamline workflows and maximize limited resources.

- Medium-sized practices can track multiple providers or locations more efficiently.

- Large practices and hospitals can monitor complex processes across departments with ease.

The bottom line? Dashboard reporting is scalable and customizable, making it a valuable tool for practices of all sizes.

Take Control of Your Revenue Cycle with Cadence Collaborative

Ready to optimize your revenue cycle and gain real-time insights into your practice’s financial health?

At Cadence Collaborative, we provide tailored dashboard reporting solutions that empower healthcare providers to reduce denials, boost cash flow, and stay compliant.

Let us help you turn complex data into actionable results—because your success is our priority.

Contact us today and discover how we can transform your revenue cycle management!