Imagine this: you’ve delivered exceptional care to your patients, submitted the necessary claims, and are ready to receive payment—only to be met with a denial. It’s frustrating, isn’t it? For many healthcare providers, it’s a reality that disrupts more than just cash flow.

Denials create extra work, pull your team away from patient care, and can leave you feeling like you’re stuck in an endless cycle of rejections and resubmissions.

But here’s the thing: denials don’t have to define your practice’s financial health. They’re just one piece of the larger puzzle that is Revenue Cycle Management (RCM).

Think of RCM as the lifeline that connects the care you provide to the revenue you need to sustain your practice. And denial management? It’s the part of RCM that helps you spot the cracks, fix them, and prevent them from happening again.

When denial management becomes a priority, it transforms more than just your billing process. It empowers your practice to focus on what truly matters: delivering care, supporting your team, and building trust with your patients.

Let’s explore how denial management can become your secret weapon in running a successful, stress-free healthcare practice.

What Is Denial Management in Healthcare?

Denial management in healthcare is the process of identifying, addressing, and preventing claim denials.

Every claim submitted represents care that was provided and costs that were incurred. When claims are denied, it’s not just a matter of reworking paperwork—it’s a direct hit to your revenue cycle.

Denials happen for various reasons, ranging from simple administrative errors to complex payer-specific policy changes. They might stem from something as basic as a typo in a patient’s name or as nuanced as missing documentation for a procedure.

The role of denial management is to uncover these reasons, address them efficiently, and create strategies to ensure they don’t happen again.

The Ripple Effects of Claim Denials

The true cost of denials often goes beyond the surface. Financially, every denied claim represents money that could have supported your practice’s operations. However, the effects aren’t limited to finances.

Your team’s time is diverted to resolve the denial, often pulling attention away from other critical tasks. Patients can also be impacted when they receive unexpected bills or encounter delays in their care.

By implementing a robust denial management process, you’re not just protecting your bottom line—you’re also enhancing your team’s productivity and improving patient trust.

Denial management is about taking control of what could otherwise become a recurring and costly problem.

Why Do Claim Denials Happen?

Claims can be denied for a multitude of reasons, and each represents a challenge to be addressed.

Common causes include incorrect patient information, outdated coding, missing documentation, and failure to meet payer-specific requirements. Policy changes from insurers can also lead to unexpected denials, leaving practices scrambling to adapt.

Denial management helps break this cycle by identifying the underlying causes of denials. It’s about asking the right questions: Was the claim accurate? Was it submitted on time? Were the payer’s policies followed?

With these answers, practices can address denials with precision and avoid repeating the same mistakes.

Different Types of Denials

In the world of denial management, not all denials are created equal. Some are final and irreversible, while others are temporary setbacks that can be corrected. Understanding these nuances is key to prioritizing efforts effectively.

Hard denials are claims that cannot be recovered. These typically occur due to non-covered services or critical errors like invalid procedure codes. Once denied, these claims represent a permanent loss.

On the other hand, soft denials are temporary and provide an opportunity for correction. These might arise from missing documentation or minor administrative mistakes. Addressing soft denials quickly can significantly impact your cash flow, preventing delays in reimbursement.

Recognizing the type of denial your practice is dealing with helps you determine the next steps. It ensures that resources are directed toward recoverable claims, while also identifying systemic issues that need to be addressed to prevent future occurrences.

Building a Denial Management Process That Works

A successful denial management strategy doesn’t just resolve individual denials—it addresses the underlying causes and implements long-term solutions. The first step in the process is identifying denials as they occur. Timely recognition is essential because the sooner you address a denial, the higher the likelihood of recovery.

Once a denial is identified, the focus shifts to understanding why it happened. This step requires careful analysis of payer feedback and a detailed review of the claim.

Was the denial due to an error in coding, missing authorization, or a lapse in compliance with payer requirements? Knowing the root cause allows you to take targeted action.

Resolving the denial often involves making corrections and resubmitting the claim with all the necessary adjustments. But the process doesn’t end there.

The insights gained from resolving a denial should be used to improve future claims. This could mean updating workflows, providing additional training to staff, or integrating better technology.

Prevention is the ultimate goal of denial management. By addressing systemic issues, you create a process that minimizes denials before they happen.

This proactive approach not only saves time but also reduces stress for your team and ensures that your revenue cycle remains robust.

Tips for Mastering Denial Management

Denial management is a continuous process, but there are proven tips to streamline it and achieve better outcomes:

- Prioritize Accurate Data Entry

Errors in patient information are a leading cause of denials. Double-check every detail, from names and insurance IDs to dates of service, before submitting a claim. - Invest in Staff Training

A knowledgeable team is your greatest asset. Regular training on coding updates, payer policies, and compliance standards ensures your staff is prepared to submit clean claims. - Leverage Technology

Modern denial management tools can automate error detection, track claims, and provide real-time insights. These systems free up your team to focus on higher-value tasks. - Stay Proactive with Payers

Build strong relationships with insurance companies to stay informed about policy changes. Regular communication can help you anticipate issues before they arise. - Monitor and Analyze Trends

Use analytics to identify patterns in denials. Are specific payers or procedures being denied more frequently? These insights guide targeted improvements.

What are the Benefits of Denial Management?

Effective denial management does more than recover lost revenue—it transforms your practice’s entire financial ecosystem.

It improves cash flow by reducing delays, enhances team productivity by minimizing rework, and builds trust with patients through transparent billing practices.

Additionally, it strengthens your compliance with payer requirements, reducing the risk of future issues.

By focusing on denial management, healthcare providers can create a more resilient revenue cycle. It’s a strategic investment that pays dividends in financial stability and patient satisfaction.

How to Prevent Claim Denials Before They Happen

Prevention is the cornerstone of effective denial management. While resolving denials is necessary, stopping them before they occur saves time, resources, and revenue.

A proactive approach involves combining accurate processes, modern tools, and a mindset of continuous improvement.

1. Ensure Clean Claims From the Start

Submitting clean claims begins with accuracy. From the moment a patient checks in, every detail matters.

Double-check patient demographics, insurance information, and eligibility before submitting a claim.

Front-desk and billing staff should work closely to verify these details in real-time, reducing the risk of administrative errors.

2. Stay Current on Coding Standards

Medical coding evolves constantly, with updates to ICD, CPT, and HCPCS codes happening regularly. These changes reflect new procedures, treatment methodologies, and payer requirements. Training your team on coding updates ensures they can submit claims accurately and avoid rejections caused by outdated codes.

3. Manage Authorizations and Documentation

Pre-authorizations are a common stumbling block for claims. Implement a robust system to track and manage authorization requirements for specific procedures.

Similarly, ensure that all necessary documentation—such as physician notes or lab results—is submitted with the claim. Missing documentation can often turn a claim into a denial.

4. Implement Timely Filing Protocols

Every payer has a specific deadline for claim submissions, and missing this window is an easy way to lose revenue.

Set up automated reminders to track filing deadlines for each payer. This simple step can help avoid preventable denials caused by late submissions.

5. Build Strong Relationships With Payers

Payers aren’t just entities that process claims—they’re partners in your revenue cycle. Establishing strong communication channels with payer representatives allows you to stay updated on policy changes and address potential issues early. Regular check-ins with payers can also help clarify ambiguous requirements.

How Denial Management Enhances RCM Efficiency

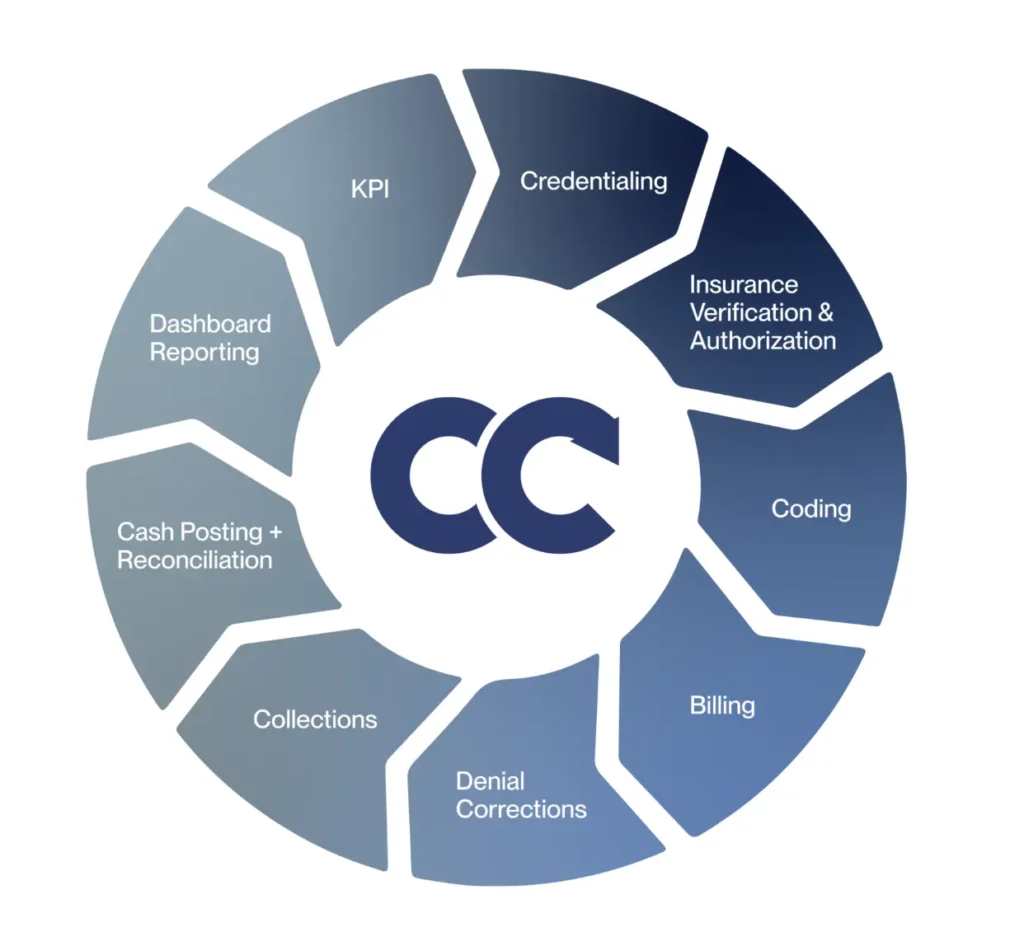

Denial management isn’t just about resolving rejected claims—it’s about optimizing the entire Revenue Cycle Management (RCM) process.

Every denial represents a gap in the revenue cycle, whether due to errors, missed deadlines, or insufficient documentation. By addressing these gaps, denial management ensures that claims flow smoothly through the system, preventing unnecessary disruptions.

What makes denial management so critical to RCM is its role in identifying patterns. For example, frequent denials from a specific payer or recurring coding errors highlight systemic issues that can be corrected upstream.

This proactive insight improves not only claim accuracy but also the overall efficiency of RCM workflows. It’s about creating a feedback loop where every denial becomes an opportunity to refine processes and prevent future disruptions.

Partner With Cadence Collaborative for Smarter Denial Management

At Cadence Collaborative, we understand that claim denials can disrupt your cash flow and create unnecessary stress for your practice. That’s why we offer tailored denial management solutions designed to simplify the process, improve accuracy, and maximize your revenue.

When you partner with us, you gain access to:

- Proven Expertise: A dedicated team with extensive knowledge of payer policies and denial trends.

- Advanced Tools: Cutting-edge technology to identify, resolve, and prevent denials effectively.

- Customized Support: Solutions tailored to the unique needs of your practice, ensuring long-term success.

Don’t let denials hold your practice back. Transform your revenue cycle with Cadence Collaborative and focus on what matters most—delivering exceptional care to your patients.

Ready to optimize your denial management? Contact us today and take the first step toward a healthier revenue cycle.