Are you confident that your practice is optimizing its revenue cycle management (RCM)?

At Cadence Collaborative, we believe that tracking the right metrics is essential for identifying inefficiencies and unlocking your practice’s full financial potential.

In this article, we’ll explore the top RCM metrics every healthcare practice should monitor, from Days in Accounts Receivable (AR) to Claim Denial Rates.

Keep reading to discover the key metrics that can drive your practice’s financial success and long-term growth.

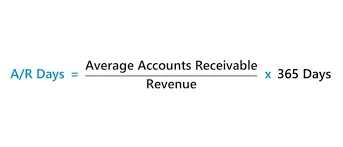

1. Days in Accounts Receivable (A/R)

Keeping track of how long it takes to get paid for the care you provide is essential for the health of your practice.

That’s where Days in A/R comes in. It’s a simple but powerful way to see how smoothly your revenue cycle is running and to spot any hiccups that might be slowing down your cash flow.

What Is Days in A/R?

Days in A/R measures the average time it takes to collect payments after a service is provided. The lower the number, the faster your practice is converting services into revenue.

Ideally, you want this number under 40 days, but the specifics can vary depending on your practice’s size and payer mix.

A high number might signal slow claim submissions, payer delays, or even challenges with patient payments.

It’s not just about numbers—it’s about making sure your hard work is recognized and compensated on time.

How Can You Reduce Days in A/R?

Lowering your days in A/R isn’t about working harder, it’s about working smarter.

- Be Quick and Accurate

Submitting clean claims right after services are provided keeps the payment process moving. Small delays or errors can snowball into weeks of waiting. - Tackle Denials Early

Denials happen, but they don’t have to slow you down. Spotting and fixing patterns in denied claims can help avoid delays in the future. - Simplify Payments for Patients

Make it easy for patients to pay by offering online options, transparent billing, and payment plans. A smooth payment experience for them means quicker revenue for you. - Keep Tabs on Your Performance

Regularly reviewing your A/R metrics gives you insight into what’s working and what’s not. It’s all about catching issues before they grow.

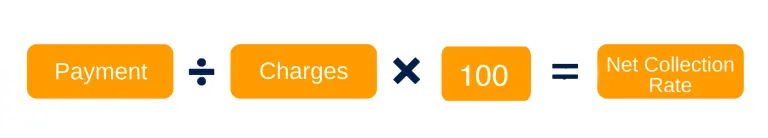

2. Net Collection Rate

When it comes to understanding your practice’s financial performance, the net collection rate is one metric you can’t afford to overlook.

It tells you how much of the revenue you’ve earned is actually being collected, helping you see the real picture of your financial health.

What Is the Net Collection Rate?

The net collection rate measures the percentage of revenue you’ve collected compared to what you’re contractually owed after adjustments, like payer discounts or write-offs.

It’s essentially a reality check—showing how effectively your practice is turning billed charges into actual payments.

A strong net collection rate (typically 95% or higher) means your processes are working efficiently to collect what you’re owed.

A lower rate suggests gaps, like unaddressed denials, uncollected balances, or other inefficiencies that could be leaving money on the table.

How Can You Improve Your Net Collection Rate?

Start by focusing on denial management. Claims that go unresolved or aren’t followed up on can quickly drag your collection rate down.

Ensure your team has a clear process for addressing denials and resubmitting claims promptly.

Another key step is improving patient payment collections. Clear communication about financial responsibilities upfront, combined with easy-to-use payment options, can significantly reduce unpaid balances.

Finally, regular performance monitoring is critical. Tracking your net collection rate over time allows you to identify trends and adjust your processes to stay on track.

At Cadence Collaborative, we help practices like yours optimize their revenue cycle to ensure every dollar earned is a dollar collected. By combining strategic insights with hands-on support, we can help you achieve a healthier, more predictable cash flow.

3. Clean Claim Rate

When it comes to getting paid on time, clean claims are the gold standard. They’re the claims that go through the system without a hitch—no edits, no rejections, just smooth processing and fast payments.

A high clean claim rate means fewer headaches and better cash flow for your practice.

What Is a Clean Claim Rate?

Your clean claim rate measures the percentage of claims that are submitted correctly the first time and approved without needing any corrections or resubmissions. It’s a direct reflection of how accurate and efficient your billing process is.

A high clean claim rate keeps payments flowing quickly and minimizes time spent chasing down denials. On the flip side, a low clean claim rate can mean wasted effort, delayed revenue, and frustrated teams.

How Can You Improve Your Clean Claim Rate?

Improving your clean claim rate starts with getting the details right from the start. Make sure all patient and insurance information is accurate and complete before submitting claims. Errors in coding, documentation, or eligibility checks are often the culprits behind rejected claims.

It’s also about consistency. Using tools or systems to flag potential issues before submission can save hours of rework. Regular audits of your claims process help identify patterns that could be causing errors, so you can fix them before they snowball.

4. First Pass Resolution Rate (FPRR)

Getting claims paid the first time they’re submitted is every practice’s goal—and that’s exactly what First Pass Resolution Rate (FPRR) measures.

A high FPRR doesn’t just mean faster payments; it also reduces the time and resources spent fixing issues, making it one of the most important metrics to track.

What Is the First Pass Resolution Rate?

FPRR is the percentage of claims paid by payers without requiring rework, such as corrections or additional documentation. It’s a direct indicator of the accuracy and efficiency of your claims submission process.

How Can You Improve Your First Pass Resolution Rate?

Improving your First Pass Resolution Rate starts with rethinking the way claims are handled from the very beginning.

A big part of the solution lies in creating a culture of precision—making sure every step in the process, from patient registration to claim submission, is thorough and accurate.

One effective approach is integrating front-end and back-end workflows. When scheduling or intake teams collect complete and correct information upfront, it sets the foundation for smoother claims processing.

This means double-checking insurance eligibility, verifying demographic details, and ensuring proper authorizations are in place before the claim even starts its journey.

5. Bad Debt Ratio

The bad debt ratio measures the portion of your total revenue that you’ve written off as uncollectible.

These are payments you’re unlikely to ever receive, typically from unpaid patient balances or claims that have aged out beyond their allowable timeframe.

A high bad debt ratio can indicate inefficiencies in billing or collection processes, as well as challenges with patient payment follow-through.

How Can You Reduce Bad Debt Ratio?

Reducing your bad debt ratio begins with setting the stage for success from the very first patient interaction.

Clear communication about financial responsibility—including co-pays, deductibles, and out-of-pocket costs—can prevent surprises later. Patients who understand their obligations upfront are more likely to pay on time.

Offering flexible payment options, like installment plans or online payment portals, makes it easier for patients to settle their balances.

Convenience can be a powerful motivator, especially for patients managing large or unexpected medical expenses.

Another important step is tightening up your follow-up process. Send reminders for overdue payments early and often, and consider working with professional collection agencies for accounts that remain unpaid after a reasonable timeframe.

Finally, review your billing and collections workflows regularly to identify patterns. Are certain services or payers contributing more to bad debt?

Pinpointing and addressing these trends can help you refine your processes and reduce write-offs.

6. Cost to Collect

The cost to collect measures the total expenses incurred to collect payments, including billing staff salaries, technology investments, claim processing fees, and follow-up costs.

Essentially, it’s how much it costs your practice to secure the revenue you’ve already earned.

A lower cost to collect means you’re running an efficient operation, while a higher number suggests inefficiencies in your billing and collection processes.

How Can You Lower Your Cost to Collect?

Lowering your cost to collect starts with streamlining your workflows. Evaluate every step of your billing process to identify where time, resources, or money might be wasted.

Automating repetitive tasks, like claim submissions and payment posting, can reduce labor costs while speeding up the process.

Patient payments are another area where efficiencies can be gained.

Offer convenient payment options—such as online portals or automated payment plans—to reduce manual work and encourage faster collections.

Clear and upfront communication about financial responsibilities also minimizes delays and follow-ups.

FAQ Section

What Is a Good Days in A/R Benchmark?

Generally, having your Days in A/R around 30 to 50 days is a good target. This means that, on average, you receive payment for services within about one to two months after you send out a bill.

For example, imagine your clinic used to wait over 60 days for payment, which caused stress and uncertainty.

By streamlining billing procedures and following up more consistently with payers, you could bring that number down to 40 days—leading to steadier cash flow and less worry about overdue payments.

How Do I Improve My Clean Claim Rate?

Improving your clean claim rate is like proofreading a letter before mailing it out. Before you send a claim, double-check that patient details are correct, codes are accurate, and coverage is verified.

Investing in claim-scrubbing software or training staff in proper coding can prevent common mistakes from slipping through.

For example, if your practice once had a 15% error rate on claims, a few training sessions and a new verification step could reduce those errors to just 5%, resulting in fewer denials and faster payments.

Why Is Net Collection Rate Important?

Your net collection rate shows how much of the money you’ve earned you’re actually bringing in. It’s like checking how often the money in your invoices makes it into your bank account.

For instance, if your clinic bills $10,000 for a month’s services but only collects $8,500, a net collection rate evaluation can help you figure out why you’re missing out on the extra $1,500. Maybe a particular insurance company underpays or a coding issue leads to denials.

Maximize Your Practice’s Financial Performance with Cadence Collaborative

Tracking metrics like Days in A/R, Clean Claim Rate, and Denial Rate isn’t just about keeping the books in order—it’s about uncovering opportunities to make your practice stronger.

These numbers hold the key to reducing delays, plugging revenue leaks, and creating a smoother, more predictable cash flow. With the right focus, they can be the foundation for lasting financial health.

At Cadence Collaborative, we don’t just crunch numbers—we bring clarity.

Our team works with you to transform these metrics into actionable insights, helping your practice thrive financially while giving you more time to focus on patient care.

Together, we simplify the complex, so you can do what you do best with confidence.

Your practice deserves more than just getting by. Let’s make things easier, smarter, and more effective.

Contact us today at +1 401-743-2428, and let’s take the first step toward a stronger, more sustainable future.