If someone mentioned “IPA” in a healthcare meeting and your first thought was craft beer… you’re definitely not alone.

But in this world, IPA doesn’t mean India Pale Ale, it stands for something far more operational (and yes, a bit more complicated): Independent Practice Association.

Whether you’re new to healthcare administration, managing provider contracts, or trying to understand how care networks actually function behind the scenes, IPAs are one of those acronyms that pop up everywhere and often go unexplained.

At Cadence Collaborative, we work with healthcare leaders and provider groups who interact with IPAs every day, whether they realize it or not. So in this guide, we’re breaking it all down.

Let’s clear up the confusion.

What Does IPA Actually Mean?

IPA stands for Independent Practice Association.

It’s a network of independent physicians, often from different specialties and practices, who join forces to negotiate contracts, coordinate care, and participate in value-based arrangements with payers or health plans.

Unlike physicians who work for a single hospital or large group, providers in an IPA maintain ownership of their own practices. The IPA is a collective structure that allows them to:

- Operate with more negotiating power

- Access better rates and managed care contracts

- Participate in care coordination initiatives

- Share administrative infrastructure without giving up independence

In short, an IPA gives small-to-mid-sized practices a seat at the table, especially when dealing with large insurance companies or entering into accountable care arrangements.

How Do IPAs Work?

Now that we’ve defined what an IPA is, let’s talk about how it actually functions behind the scenes.

At its core, an Independent Practice Association is a legal and administrative entity that connects independent providers under one umbrella, not to control them, but to help them work together more efficiently, especially in today’s complex reimbursement environment.

Here’s what that looks like in action:

Contracting as a Group (Without Merging Practices)

One of the biggest reasons providers join an IPA is to gain collective leverage in payer negotiations. Instead of each practice trying to negotiate rates with commercial insurers or Medicare Advantage plans on its own, the IPA negotiates on behalf of the network.

This can include:

- Fee-for-service contracts

- Capitated arrangements

- Value-based payment models

- Shared savings or risk-sharing agreements

Providers don’t give up ownership of their practice or billing; they simply agree to abide by certain standards and participate in joint contracts.

Shared Administrative Support

Many IPAs offer shared services that help reduce the operational burden on individual practices. This might include:

- Credentialing

- Prior authorization assistance

- EHR interoperability support

- Utilization review

- Centralized quality reporting

This kind of infrastructure is especially helpful for smaller practices trying to keep up with payer demands, CMS quality programs, and revenue cycle management workflows that are constantly changing.

Clinical Coordination and Quality Initiatives

IPAs aren’t just about billing and contracting; many also work to improve clinical integration across the network.

This can include:

- Standardized care protocols

- Data-sharing between specialists and primary care

- Population health initiatives

- Preventive care campaigns

- Tracking and improving performance on HEDIS, STAR, or NCQA metrics

The goal? To provide better care across a decentralized network while also meeting the benchmarks that insurers increasingly expect in value-based care models.

Governance and Funding

Most IPAs are governed by a board of physicians, usually elected from within the participating network. The structure may include subcommittees for things like quality, finance, and contracting.

As for funding, IPAs are typically financed through:

- Membership dues from participating practices

- Administrative fees collected from negotiated payer contracts

- Shared savings pools (when value-based care arrangements apply)

- Occasionally, investment from health systems or MSOs

IPA vs. ACO vs. MSO: What’s the Difference?

In healthcare, acronyms fly around like confetti, and IPA, ACO, and MSO are some of the most misunderstood. While they all deal with provider networks, contracts, and coordination, they each serve a different function in the system.

Here’s a plain-English breakdown to help you keep them straight.

IPA: Independent Practice Association

As we covered, an IPA is a network of independent providers who come together for contracting power, administrative support, and collaborative care, but remain independent.

- Ownership: Practices stay private and physician-owned

- Focus: Joint contracts, quality programs, shared services

- Revenue: Membership dues, shared risk savings, admin fees

- Best For: Independent practices looking to scale up without giving up control

ACO: Accountable Care Organization

An ACO is a formal entity made up of providers who take collective responsibility for cost, quality, and outcomes for a defined patient population, often Medicare beneficiaries.

- Ownership: May include hospitals, health systems, and physician groups

- Focus: Cost savings + quality targets for shared savings models

- Revenue: Earned by reducing the total cost of care while meeting quality benchmarks

- Best For: Organizations ready to manage financial risk in exchange for upside

MSO: Management Services Organization

An MSO provides non-clinical business and administrative services to physician groups and healthcare organizations.

- Ownership: Can be physician-owned, hospital-owned, or investor-backed

- Focus: Outsourced services like billing, HR, IT, marketing, and compliance

- Revenue: Fee-based or percentage-of-revenue contracts

- Best For: Providers who want to focus on care delivery while outsourcing operations

Key Difference: An MSO doesn’t manage clinical care or negotiate payer contracts. It’s a business support layer, not a network or clinical entity.

Quick Recap

| Acronym | Core Role | Who It Supports | What It Manages |

| IPA | Clinical and contracting collaboration | Independent practices | Contracts, quality programs |

| ACO | Risk-based care delivery and outcomes | Provider networks (incl. IPAs) | Cost, quality, outcomes |

| MSO | Admin and business services | Any provider/org | Operations, compliance, and billing |

Benefits of Joining an IPA (And the Risks to Watch For)

Joining an IPA isn’t just a checkbox; it’s a strategic business move that can shape your practice’s future. But like any structural shift in healthcare, it comes with both opportunities and trade-offs.

At Cadence Collaborative, we work with providers navigating these decisions every day. Here’s what we’ve seen work, and what to look out for.

Greater Contracting Leverage

As a solo or small group practice, negotiating directly with commercial payers can feel like an uphill battle. But inside an IPA, providers gain collective strength, becoming part of a larger, more organized network with better positioning during payer negotiations.

Instead of going it alone, you gain access to:

- Jointly negotiated fee-for-service contracts

- Inclusion in value-based care arrangements

- Preferred rates and participation in narrow networks

For practices looking to stay independent while remaining competitive, this is one of the most compelling benefits.

Entry Point to Value-Based Care Models

Value-based care is no longer optional. From Medicare Advantage to commercial contracts, payers are shifting toward models that reward quality and efficiency. But these models often require infrastructure and scale, which many solo practices can’t provide alone.

IPAs often offer the structure needed to:

- Participate in shared savings or downside risk models

- Track and report on quality metrics

- Align with population health goals

With Cadence Collaborative as your partner, we help ensure your IPA involvement integrates smoothly with your existing medical billing and revenue cycle management workflows, so that financial incentives are matched with operational clarity.

Shared Administrative Support

Credentialing. Prior authorizations. EHR headaches. HEDIS reporting. It’s a lot, especially for lean practices.

Many IPAs offer administrative infrastructure that eases the burden on individual providers. This might include:

- Centralized credentialing and contracting

- Referral management tools

- Integrated tech platforms

- Support with quality reporting and compliance

For organizations looking to scale operations without significantly growing headcount, this shared support can be a game-changer.

Improved Clinical Collaboration and Referrals

In well-functioning IPAs, care isn’t just coordinated on paper; it flows naturally through trusted networks. This often leads to:

- Better communication between primary care and specialists

- Fewer gaps in care

- Standardized protocols and shared quality goals

- Stronger referral pipelines within the network

This kind of collaboration improves both care delivery and patient outcomes, which also improves financial performance in value-based contracts.

More Strategic Growth Potential

Joining an IPA doesn’t mean giving up your independence.

It means aligning your practice with others who are also serious about staying viable, adapting to new payment models, and accessing new opportunities, without having to sell to a hospital system.

Risks to Watch For

Not all IPA experiences are created equal.

While many deliver tremendous value, others may create friction or expose your practice to new challenges. It’s important to enter the arrangement with eyes wide open.

Potential Loss of Autonomy

While you still own and operate your practice, participation in an IPA often comes with shared governance, group-level decisions, and clinical alignment requirements.

You may be asked to follow:

- Standardized care protocols

- Group-level referral agreements

- Performance benchmarks or incentive structures

This isn’t inherently bad, but it does mean that “independence” now includes shared responsibility.

Uneven Performance Within the Network

If your IPA engages in shared savings or downside risk models, your results may depend on the performance of others.

One underperforming provider can affect the entire group’s outcomes and your potential earnings.

At Cadence Collaborative, we help teams set up internal benchmarking and accountability systems so you’re never left wondering how you’re being measured or impacted by your peers.

More Layers of Administrative Complexity

Sometimes the promise of simplification turns into duplicated work, especially if the IPA’s tools and workflows aren’t well integrated with your own.

You might find yourself juggling:

- Multiple billing systems

- Redundant quality reporting

- Delays in prior authorizations due to unclear handoffs

Lack of Transparency in Governance or Revenue Distribution

Before joining, always ask:

- Who governs the IPA?

- How are shared savings distributed?

- What data will you have access to, and how often?

If those answers aren’t clear, it’s worth pressing pause until they are.

How IPA Participation Impacts Billing and Revenue Cycle Management

One of the most overlooked, yet deeply consequential, aspects of joining an IPA is how it will affect your billing workflows, your financial reporting, and your ability to manage your revenue cycle effectively.

At Cadence Collaborative, we’ve worked with many provider groups navigating these transitions.

Some come in with well-oiled internal systems, only to find out that IPA participation changes the game.

Here’s what to expect and how to stay ahead of the curve.

Contract Structure Dictates Billing Rules

First, understand that your billing rights may change depending on the payer agreements negotiated by the IPA.

You might still bill under your own TIN (Tax ID Number), but if the IPA holds the contract, the rules around:

- Reimbursement rates

- Submission formats

- Bundled services

- Risk adjustments

- Denial management

…could all shift.

That means your billing team needs to track which contracts are yours and which are IPA-managed, and adapt the workflows accordingly.

Prior Auths and Payer Communication May Shift to the IPA

Many IPAs centralize authorization processes and payer communication, especially when working with high-volume procedures or chronic care populations.

This can be a benefit if the IPA has strong systems in place.

But in reality, many practices experience:

- Delays in getting auths approved

- Lack of visibility into payer conversations

- Duplicate or conflicting communication with patients and insurers

To avoid this, we recommend setting up clear coordination points and using shared platforms for documentation and status tracking. This is something Cadence often supports during IPA onboarding.

Reconciliation Gets More Complex

When payers send checks to the IPA rather than directly to your practice, you’ll likely be reimbursed through periodic distributions based on your share of the contract or your performance.

This can make revenue forecasting and reconciliation more difficult unless:

- You have detailed reporting on what was billed vs. what was paid

- You understand the timing of IPA disbursements

- You’re looped into how shared savings or risk pools are distributed

Risk and Incentive Models Require More Sophistication

When you’re participating in value-based contracts through an IPA, revenue is no longer tied solely to volume; it’s tied to performance. That includes:

- Cost savings

- Quality scores

- Patient outcomes

- Benchmark comparisons

This means your billing and RCM teams must be fluent in risk adjustment coding, quality measure documentation, and performance-based reporting.

Let Cadence Collaborative Be Your Guide

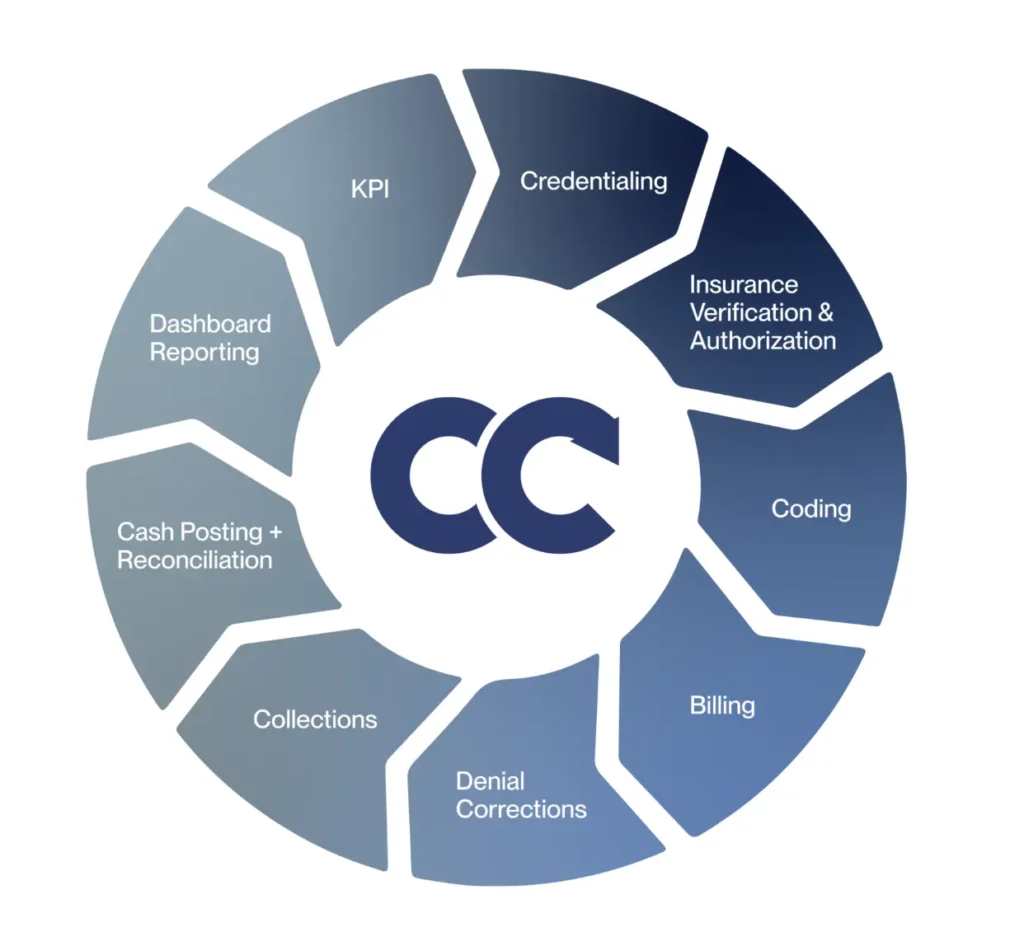

At Cadence Collaborative, we help healthcare organizations evaluate IPA opportunities, optimize their medical billing and coding workflows, and build RCM systems that support both independence and growth.

Whether you’re negotiating new contracts, entering value-based care, or simply trying to get better visibility into your performance data, we bring the operational clarity and strategic support to make every decision smarter.

Ready to explore what’s next? Contact us and let’s talk about how to make your IPA strategy work for your team, your patients, and your revenue.