When it comes to healthcare, most conversations center around patient care—but let’s talk about something just as critical: getting paid for that care.

If you’re a healthcare provider, you know how frustrating it can be when billing issues or delayed payments get in the way of running your practice smoothly.

This is where Revenue Cycle Management (RCM) becomes your best ally. At its core, RCM is about making sure every dollar you’re owed finds its way to you—quickly and efficiently.

Strong collections mean more than just a healthy cash flow; they allow you to reinvest in technology, staff, and ultimately, better patient care.

In this guide, we’ll break down how you can improve your collections process, avoid common pitfalls, and build a stronger financial foundation for your practice.

Let’s start by understanding what healthcare collections are and why they matter.

What Are Healthcare Collections and Why Do They Matter?

Healthcare collections are exactly what they sound like—getting paid for the services you provide.

But it’s not as simple as sending out a bill. Between insurance companies, co-pays, and patient balances, collections can turn into a tangled web of confusion.

And when payments don’t come in on time, it doesn’t just affect your bottom line—it impacts your ability to deliver care.

That’s why collections are a crucial part of RCM. The goal is to minimize delays, cut through red tape, and make sure every payment is accounted for. But to do that, you need a solid system in place.

How to Improve Your Healthcare Collections: Start with the Basics

Improving collections doesn’t happen overnight, but taking the right steps can make a big difference. Here’s where to start:

1. Know Your Numbers

Do you know your current collection rate? How long does it take your practice to get paid? Start by reviewing your metrics. These numbers give you a clear picture of where things stand—and where you can improve.

2. Verify Insurance Upfront

Many collection issues start with incorrect insurance details.

Make it a habit to verify insurance coverage before every appointment. It saves time, reduces claim denials, and sets the right expectations with patients.

3. Communicate Clearly with Patients

Clear, upfront communication about costs and payment expectations goes a long way. Patients are more likely to pay when they understand their responsibility and feel supported by your team.

Why Strong Collections Are the Heart of RCM

Imagine this: you’ve provided excellent care, the patient has left satisfied, but weeks go by, and the payment you’re owed is nowhere to be found.

This isn’t just frustrating—it’s unsustainable. Revenue Cycle Management (RCM) is built around ensuring this doesn’t happen.

At its core, RCM is the process of managing everything from patient registration to final payment collection. Strong collections ensure the entire cycle flows smoothly, without unnecessary delays or denials.

And when your collections are optimized, your practice benefits from predictable cash flow, fewer headaches, and more time to focus on what truly matters—your patients.

How to Build a Better Collections Process: Strategies That Work

So, how do you transform collections from a stress point into a streamlined process? It starts with a few key strategies:

1. Embrace Technology for Seamless Billing

Manual processes leave too much room for error. Investing in a reliable billing system or partnering with a tech-savvy RCM provider can help automate tasks like claim submissions and payment tracking.

The result? Fewer mistakes, faster payments, and happier staff.

2. Be Proactive with Denial Management

Claim denials are a major roadblock to timely collections. Instead of waiting for rejections to pile up, implement a denial management strategy.

Review claims thoroughly before submission, and follow up promptly on any that are denied. Prevention is always better than correction.

3. Train Your Team to Prioritize Collections

Your front desk and billing teams are your first line of defense when it comes to collections.

Equip them with the right training to handle patient inquiries, verify insurance accurately, and set payment expectations from the start.

4. Offer Flexible Payment Options

Sometimes, patients need a little help meeting their financial obligations.

Offering options like payment plans or online payment portals can make it easier for them to pay on time—without the added stress.

What Happens When Collections Improve?

The impact of better collections goes beyond dollars and cents.

When your practice is financially healthy, it opens the door to better resources, higher-quality care, and a more satisfied team. Imagine being able to:

- Invest in state-of-the-art equipment.

- Expand your team with skilled professionals.

- Focus on growth opportunities rather than chasing payments.

It all starts with a solid collection process.

And the best part? The changes you make today will continue paying off for years to come.

What Patients Want: How Transparency Improves Collections

Let’s face it—healthcare billing can feel like a mystery to patients. Confusing medical bills and unexpected charges create frustration and mistrust.

But here’s the good news: being transparent about costs not only builds trust but also improves your collections.

Clear Communication is Key

Start by giving patients a detailed breakdown of their financial responsibility before services are rendered.

Whether it’s through an online cost estimator or an in-person conversation, clarity prevents surprises and makes it more likely they’ll pay on time.

Make Payment Simple

Patients want convenience, especially when it comes to paying bills. Offer multiple ways to pay: online portals, mobile apps, or even payment kiosks at your office. The easier it is, the quicker they’ll settle their accounts.

What is the Role of Follow-Up in Collections?

Even with the best systems in place, not every patient pays on time. This is where follow-up becomes crucial.

A well-designed follow-up process ensures no payment slips through the cracks while maintaining a positive relationship with patients.

Automate Friendly Reminders

Set up automated reminders for due dates via email, SMS, or phone calls. A gentle nudge can go a long way in prompting action without feeling invasive.

Know When to Escalate

For balances that remain unpaid, have a plan in place.

Whether it’s sending additional notices or involving a collections agency, ensure your escalation process is respectful and compliant with regulations.

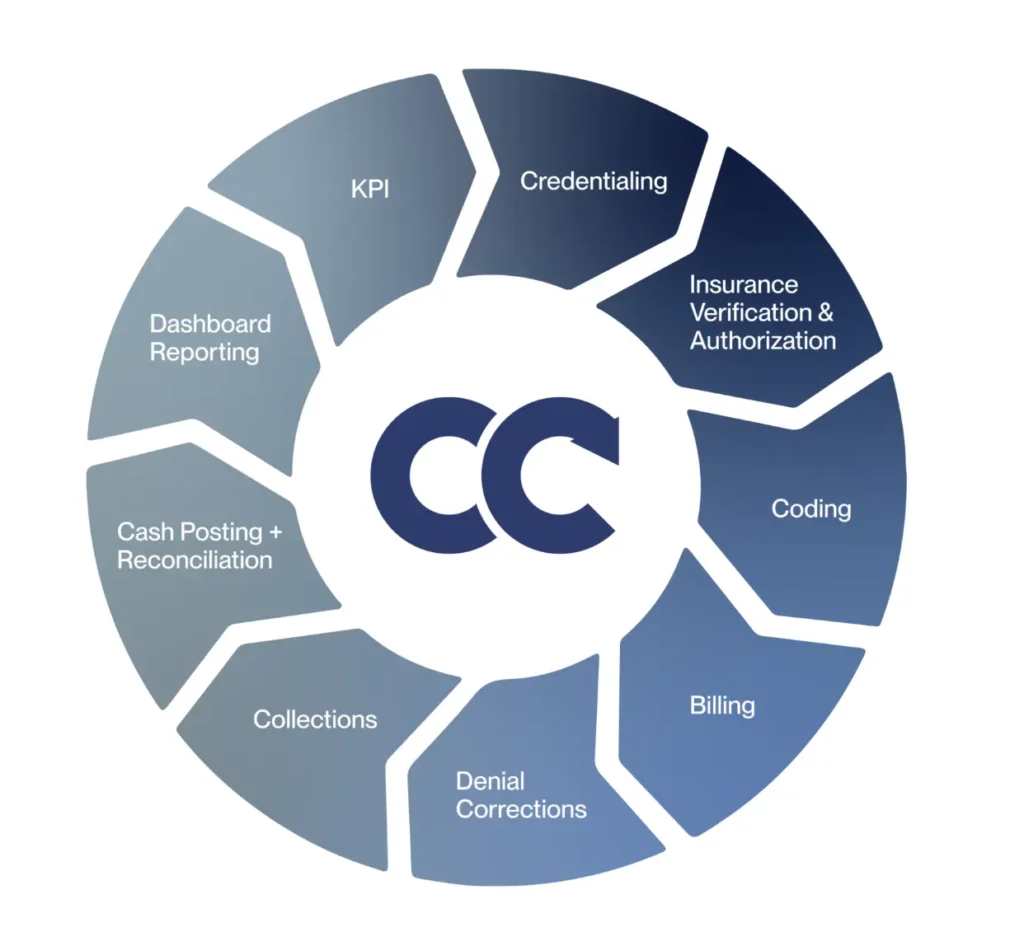

Transforming Collections with Cadence Collaborative

At Cadence Collaborative, we understand that the financial side of healthcare is just as critical as the clinical.

Our expertise in Revenue Cycle Management allows us to support healthcare providers with innovative, efficient, and compliant solutions that simplify collections and boost cash flow.

When you partner with us, you gain more than just a service provider—you gain a collaborator committed to your success.

With tailored strategies and industry-leading tools, we’re here to ensure your financial operations work as smoothly as your clinical ones.

Whether you’re looking to streamline your processes, reduce claim denials, or create a more patient-friendly billing system, we have the expertise to make it happen.

Your success is our mission—and it starts with a single step toward better collections. Contact us today!