Running a primary care practice means being the first line of defense for patient health. You handle everything—from routine checkups to chronic disease management.

But while you’re busy taking care of patients, who’s taking care of your revenue?

Let’s be real: billing for primary care shouldn’t be this complicated. Yet, practices across the country deal with:

- Delayed insurance reimbursements that create unpredictable cash flow.

- Claim denials and rejections that take weeks (or months) to fix.

- Patients with high deductibles who struggle to pay out-of-pocket costs.

Without a structured billing and revenue system, even a successful primary care practice can find itself in financial trouble.

The good news? Fixing it doesn’t mean more work for you. It means working smarter.

Let’s break down the biggest revenue challenges primary care practices face—and how to solve them.

Why Is Primary Care Billing So Challenging?

Most providers assume that billing should be straightforward—after all, primary care services are some of the most essential in medicine. But the reality? Insurance companies, coding rules, and reimbursement policies create endless roadblocks.

Here’s why practices struggle to keep revenue flowing:

1. Insurance Companies Delay Payments (On Purpose)

It’s no secret: insurance companies aren’t in a rush to pay you. They take advantage of every loophole to delay reimbursements, including:

- “Pending verification” excuses that add unnecessary waiting time.

- Requesting additional documentation—even when everything was submitted correctly.

- Arbitrary policy changes that make it harder to get claims approved.

What you can do: A structured billing and revenue process tracks claims in real-time, follows up aggressively, and ensures clean submissions, so payments aren’t left hanging.

2. Claim Denials Are Eating Into Your Revenue

Denied claims are one of the biggest reasons primary care practices lose money. And most denials? Completely preventable.

Common reasons claims get rejected:

❌ Missing or incorrect diagnosis codes (especially for chronic conditions).

❌ Lack of medical necessity documentation, even for routine preventive care.

❌ Wrong modifiers or place-of-service codes for telehealth vs. in-person visits.

What you can do: Instead of fixing denials after they happen, a strong revenue system flags issues before claims are submitted—so your practice gets paid the first time.

3. Patients Are Struggling to Pay Their Bills

With high deductibles and out-of-pocket costs rising, collecting payments from patients has never been harder.

If you’re waiting for patients to pay their bills weeks or months after service, your cash flow is already suffering.

Why patients don’t pay on time:

- They don’t understand what they owe until they get a surprise bill.

- They assume insurance will cover more than it actually does.

- They can’t afford to pay a large balance all at once.

4. You’re Leaving Money on the Table with Underbilling

Most primary care providers focus so much on avoiding overbilling that they don’t realize they’re underbilling.

This means:

- Not capturing all billable services provided during a visit.

- Using outdated codes that no longer match reimbursement rates.

- Skipping add-on codes for extended visits, additional screenings, or care coordination.

🔍 What you can do: Regular billing audits and coding updates ensure your practice bills accurately—and fully—for every service provided.

5. Your Revenue Feels Unpredictable

Does your revenue cycle feel like a rollercoaster? One month, payments are steady. The next, you’re wondering where the money went.

This happens because:

- Claims aren’t getting submitted consistently.

- Denials aren’t followed up on fast enough.

- Payments from both insurance and patients are coming in sporadically.

🔍 What you can do: A well-managed billing system ensures:

- Claims are submitted on time, every time.

- Denials are worked and reprocessed fast.

- Patient balances are actively collected.

How Many Unbilled Services Are Slipping Through the Cracks?

Every primary care provider has done work they didn’t bill for—whether it’s patient education, chronic care management, or extended visits.

It happens so often that many providers don’t even realize how much they’re leaving on the table.

Are you billing for:

- Chronic Care Management (CCM)? Medicare and many commercial payers reimburse for care coordination services outside of in-person visits.

- Prolonged evaluation and management (E/M) services? Extended visits should be billed with appropriate add-on codes.

- Preventive screenings that insurers cover 100%? Some services, like depression screenings or annual wellness visits, are often overlooked in the coding process.

If your practice isn’t regularly auditing its own billing patterns, you could be underbilling without even realizing it.

Medicare and Private Payers Aren’t Playing by the Same Rules

Just because a service is covered by Medicare doesn’t mean it will be reimbursed the same way by private insurers.

Many practices assume that if Medicare pays for something, commercial payers will too—but that’s not always the case.

Insurance companies each have their own:

- Reimbursement structures (what they’ll actually pay for a service).

- Medical necessity criteria (what conditions justify a certain level of care).

- Pre-authorization requirements (some require approval before a procedure, others don’t).

If your billing strategy doesn’t account for these differences, you’re likely seeing inconsistent payments and unnecessary denials.

The Hidden Impact of Writing Off Too Many Patient Balances

You see a patient, submit the claim, and insurance pays their part. But what happens when the patient never pays their balance?

Many primary care practices write off patient balances too easily, assuming it’s not worth the hassle to chase down payments.

Here’s why that’s a problem:

- Unpaid balances add up quickly. A few missed copays here and there turn into thousands in lost revenue.

- Patients get used to not paying. If there’s no follow-up, patients assume they can ignore their bills without consequences.

- Your cash flow suffers. Insurance payments alone aren’t enough to keep your practice financially stable.

Instead of writing off balances, implement a clear patient collection strategy that includes upfront cost estimates, automated reminders, and flexible payment options.

How to Bill for Complex Visits Without Triggering a Red Flag

Primary care providers handle complex cases all the time, but many hesitate to bill for higher-level visits because they worry about audits.

Here’s the reality:

- If you spend extra time with a patient managing multiple chronic conditions, you should bill accordingly.

- If you coordinate care between specialists, that time is reimbursable under certain codes.

- If a visit requires extra documentation or medical decision-making, it should be reflected in the billing.

As long as your documentation supports the level of service billed, there’s no reason to undercode out of fear.

Why Your Reimbursement Rates Are Dropping Without You Noticing

You might assume that insurance companies pay you the same rates year after year—but have you actually checked?

Reimbursement rates change regularly, and many practices don’t realize they’re getting paid less for the same services until it’s too late. If you’re not reviewing your payer contracts and renegotiating rates, you could be losing revenue without even realizing it.

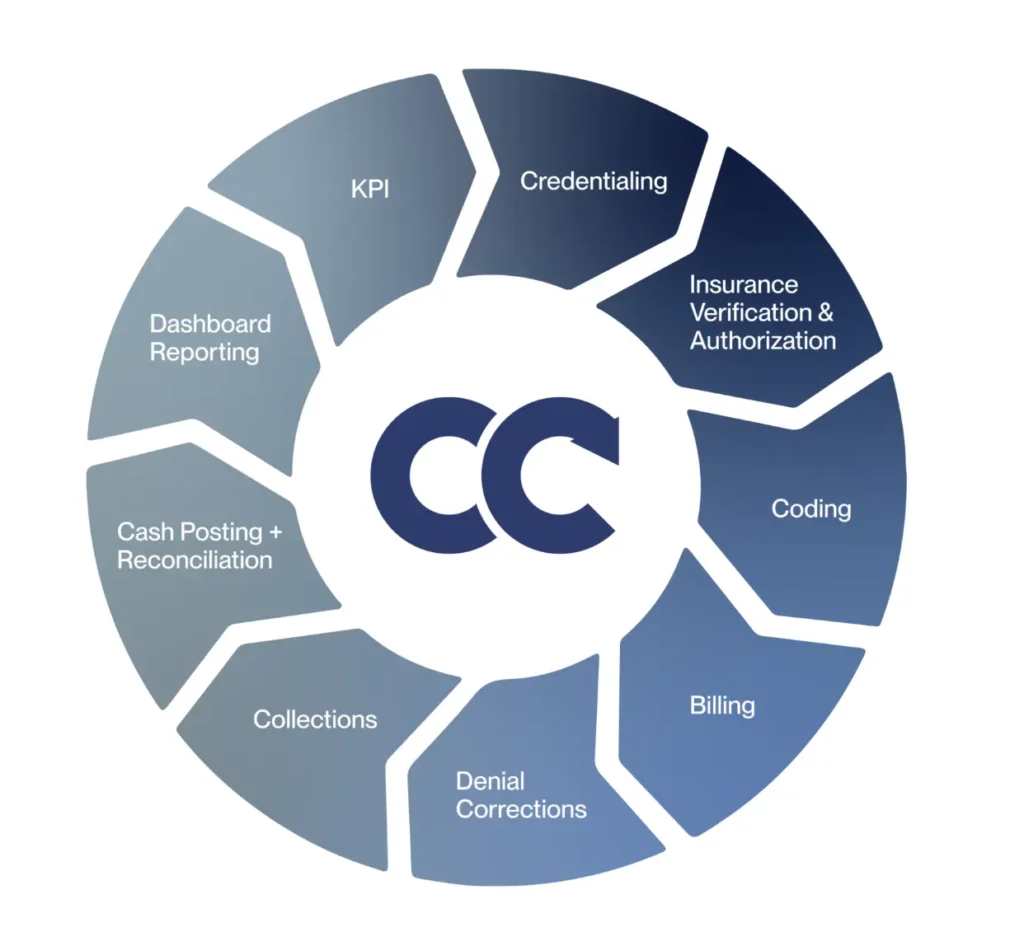

Your Revenue Should Work for You—Not Against You

Managing a primary care practice is hard enough without billing issues draining your time and revenue.

The right billing and revenue cycle process ensures:

✔ Insurance payments arrive on time, without unnecessary delays.

✔ Claims are approved the first time, minimizing revenue loss.

✔ Patients understand and pay their balances faster.

✔ Your practice has predictable cash flow—so you can plan for growth.

At Cadence Collaborative, we specialize in helping primary care practices take control of their revenue cycle—without adding more work to your plate.

Let’s fix your coding and billing. Contact us today and see how we can help your practice thrive—without the financial headaches.