Let’s face it: healthcare revenue cycle management (RCM) can feel like a high-stakes puzzle. From scheduling appointments to final payment collection, every piece plays a role in keeping your practice financially healthy.

And one of the most critical pieces? Cash posting and reconciliation.

When done right, they offer clarity and control, showing you where your revenue stands and where it might be slipping through the cracks.

But let’s be honest: cash posting and reconciliation aren’t always straightforward. Maybe you’ve struggled with delayed insurance payments or reconciling discrepancies that seem to pop up out of nowhere. If that sounds familiar, you’re not alone.

This blog isn’t here to overwhelm you with jargon or generic advice. Instead, we’re diving into practical, human-centered strategies to simplify cash posting and reconciliation.

Whether you’re a practice manager, billing specialist, or provider, these insights will help you reclaim control, reduce stress, and strengthen your RCM.

What Is Cash Posting in Healthcare?

Cash posting is more than just entering payments into your system—it’s where financial clarity begins. It’s the process of recording every payment your practice receives, whether it’s from patients, insurance companies, or third-party payers.

Why does it matter? Because this step tells the real story of your revenue. It shows whether claims are being paid on time, if patient balances are being met, and how efficient your billing cycle really is.

Without clean, accurate cash posting, the entire revenue cycle can feel like guesswork.

What Is Reconciliation in Healthcare?

Reconciliation is the final step that ensures everything balances. It’s the process of comparing the payments you’ve posted against your bank statements, EOBs, and ERAs to confirm accuracy.

Think of it as a financial double-check—it ensures no payment has been missed, over-applied, or misallocated.

Done regularly, reconciliation keeps your books accurate, your patients happy, and your revenue cycle running smoothly.

What Are the Types of Payments in Cash Posting?

Cash posting in healthcare isn’t just about recording payments; it’s about navigating a variety of payment types, each with its own complexities. Here’s a breakdown:

- Electronic Remittance Advice (ERA): These automated payment details from insurers speed up posting but aren’t foolproof. Mismatches between ERA data and your system can still occur and require attention.

- Manual Payments: Think checks, credit card payments, or secondary payer reimbursements. These require extra scrutiny since they’re more prone to manual entry errors.

- Patient Portal Payments: Many systems now support online payment options, but these must be mapped correctly to patient accounts to avoid errors.

Understanding the unique challenges of each payment type is key to applying payments accurately and keeping your revenue cycle flowing smoothly.

Why Are Contractual Adjustments and Denials So Important?

Every payment you receive isn’t just a transaction—it’s tied to a payer agreement. This is where contractual adjustments come in. These are the differences between what you billed and what the insurance agreed to pay.

- Why it matters: Misclassifying these adjustments can overinflate your accounts receivable (AR) and skew financial reports.

- Pro Tip: Use automation to flag adjustments that don’t align with payer contracts for faster review.

Denials often appear alongside these adjustments, and recognizing them during cash posting ensures they’re routed to your team for appeal or correction without delay.

How Do You Handle Partial Payments?

Partial payments, whether from insurance or patients, are common in healthcare. They require careful handling to ensure accuracy:

- Split Payments: Some payers may allocate only part of a payment to a specific service, leaving others unpaid. Splitting payments correctly ensures unresolved claims don’t get marked as complete.

- Secondary Insurance Transfers: When the initial payment doesn’t cover the charge, the remaining balance often needs to be sent to secondary insurance or billed to the patient. Automating this process reduces errors and keeps the workflow efficient.

What About Overpayments and Credit Balances?

Sometimes payments exceed what’s owed, creating credit balances, which are essentially liabilities for your practice.

- Why this is tricky: Mismanaging overpayments can result in compliance risks or penalties, especially during audits.

- How to fix it: Create a process to identify and validate credit balances quickly. Then, decide whether to refund the overpayment or reallocate it to outstanding charges.

Can Automation Improve Cash Posting?

Absolutely. In fact, automation is transforming cash posting in healthcare:

- Automated ERA Posting: These tools sync ERA files directly into your system, reducing manual entry errors.

- AI-Powered Tools: Artificial intelligence can flag unusual adjustments or denial patterns, giving your team a heads-up before small issues grow.

- Real-Time Dashboards: These dashboards track trends like rising patient responsibility or underpayments, helping you stay ahead.

Why Reporting and Analytics Matter in Cash Posting

Reporting and analytics help you fine-tune your processes and identify areas for improvement.

For instance, tracking days in accounts receivable (AR) reveals how quickly payments are being posted after they’re received. If delays occur, it could indicate inefficiencies in your workflow that need addressing.

Another key metric is write-off ratios, which show whether adjustments align with payer contracts. Deviations from expected ranges might highlight errors in contractual adjustments or opportunities to negotiate better agreements with payers.

Lastly, unapplied payments—funds that haven’t been matched to specific accounts or charges—can signal overlooked revenue. Regularly monitoring unapplied balances ensures that every dollar is accounted for, strengthening your financial stability.

By using these metrics effectively, you can spot inefficiencies, improve your cash posting accuracy, and create a more robust revenue cycle.

Four-Step Process for Better Cash Reconciliation

Reconciliation might sound tedious, but it’s a critical process for keeping your financial house in order. At its core, reconciliation is about ensuring that the payments recorded in your system match what you’ve actually received in your bank account and payer reports.

Here’s how to make the process smoother and more effective:

- Start with the right tools.

Invest in a reliable practice management system (PMS) or revenue cycle management (RCM) software that simplifies reconciliation. The right tools allow you to pull reports, compare balances, and identify discrepancies with ease. - Reconcile regularly.

Waiting too long between reconciliations can turn small issues into big problems. Set a daily or weekly schedule to compare posted payments against your bank statements and payer remittances. Regularity ensures you catch errors before they snowball. - Investigate and resolve discrepancies.

No matter how precise your process is, discrepancies will happen. They might come from duplicate payments, insurance adjustments, or human error. The key is not to panic. Create a system for investigating discrepancies—flag them in your system, contact payers when needed, and ensure they’re resolved promptly. - Close the loop.

Once reconciled, close the financial period to lock in accurate reporting. This prevents retroactive changes and ensures your financial reports reflect reality.

Why Errors in Reconciliation Hurt More Than You Think

Reconciliation isn’t just about balance sheets; it’s about trust. Errors in this stage can lead to:

- Patient frustration. Imagine a patient receiving a bill for a balance they already paid. It’s a surefire way to damage trust.

- Missed revenue. If you fail to spot underpayments or unapplied funds, your practice loses money you’ve already earned.

- Audit risks. Accurate reconciliation reduces your vulnerability during audits by ensuring a clear, consistent record of every dollar received and applied.

By prioritizing reconciliation, you’re not just protecting your bottom line—you’re creating a system that inspires confidence for everyone involved.

How Cash Posting and Reconciliation Interact in the RCM

When cash posting and reconciliation work together, they ensure every payment is accounted for and every discrepancy resolved.

Think of cash posting as creating the map and reconciliation as checking the route—both are essential to reaching your financial goals.

Why One Can’t Work Without the Other

Cash posting records the payments you receive, but without reconciliation, you can’t confirm that the amounts match what’s in your bank account or payer statements. Reconciliation relies on accurate posting to detect issues like missing payments or mismatched adjustments. Together, they keep your revenue cycle running smoothly.

How Cash Posting Sets the Stage for Reconciliation

Cash posting creates the foundation by organizing payment data. Each payment—whether from a patient or an insurer—is applied to the appropriate account. When this process is done correctly, reconciliation becomes a straightforward process of matching numbers, not a hunt for errors.

- Example: If a payer sends a $5,000 bulk payment for multiple claims, proper posting ensures each claim is updated accurately. Reconciliation then verifies that the $5,000 in your system matches the deposit in your bank account.

The Role of Reconciliation in Fixing Errors

Even with the best systems, mistakes happen. Reconciliation catches those errors and ensures they’re corrected quickly.

- Missed Payments: If cash posting overlooks a payment, reconciliation will flag it when the totals don’t match.

- Overpayments: Sometimes insurers or patients pay too much. Reconciliation identifies these overpayments so they can be refunded or reallocated.

- Unapplied Funds: Payments sitting in suspense accounts are a common issue. Reconciliation helps resolve these funds by matching them to the right accounts or claims.

The Benefits of Syncing Cash Posting and Reconciliation

When these processes are integrated and efficient, your practice benefits in several ways:

- Faster Revenue Recognition: Payments are recorded and reconciled quickly, reducing delays in recognizing revenue.

- Accurate Financial Reports: Clean posting and timely reconciliation ensure your financial statements reflect reality.

- Better Patient Trust: Patients appreciate accurate billing and clear account balances, which rely on error-free posting and reconciliation.

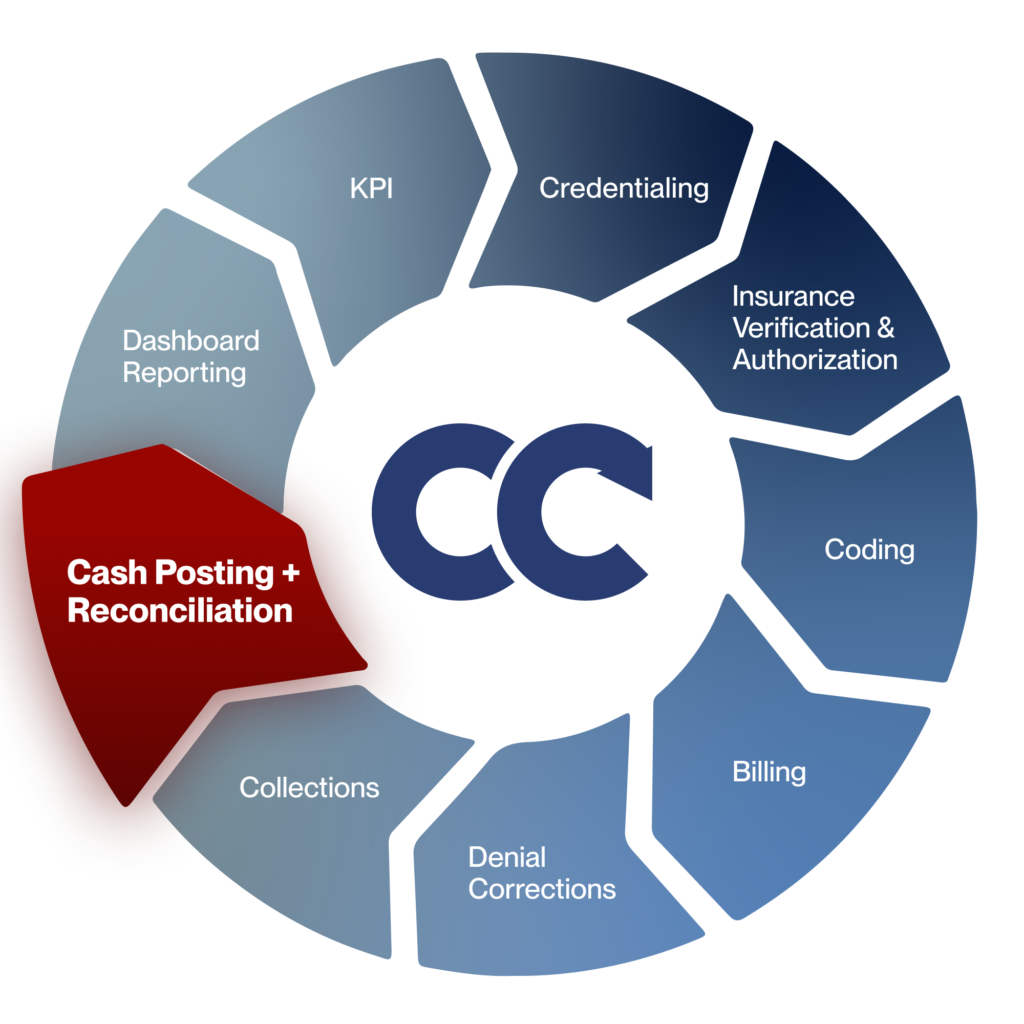

Perfect Your Revenue Cycle with Cadence Collaborative

Your practice deserves more than just a band-aid solution for cash posting and reconciliation.

We, at Cadence Collaborative, offer a holistic approach to revenue cycle management, giving you the tools, training, and strategies to perfect these processes and much more.

How we help:

- Seamless Integration: We connect with your existing systems, making it easy to post payments and reconcile accounts without delays.

- Data-Driven Insights: Our analytics reveal trends and inefficiencies, helping you refine your RCM for long-term success.

- Ongoing Support: We don’t just set up solutions—we partner with your team to ensure sustained improvements and measurable results.

Your revenue cycle should work for you, not against you. Contact us and take the first step toward financial clarity today.